| The Wagner Daily ETF Report For September 25 |

| By Deron Wagner |

Published

09/25/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 25

Keeping the bears in check, stocks snapped back from a substantial, three-day losing streak yesterday. The NASDAQ Composite jumped 1.0%, the Dow advanced 0.9%, and the S&P 500 rose 0.8%.

Most importantly, total volume ticked slightly higher in the NYSE and NASDAQ, enabling both exchanges to register a bullish "accumulation day" that was indicative of institutional buying.

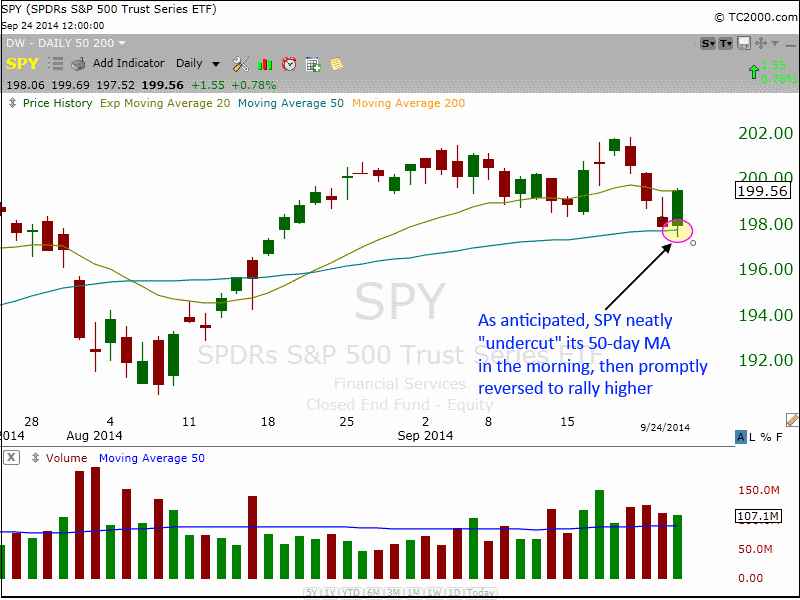

When the market opened yesterday morning, I said to subscribers in our Live Mentorship Room that the S&P 500 would likely dip below ("undercut") key support of its 50-day moving average before buyers stepped back in. That scenario played out exactly as anticipated.

Within the first 20 minutes of trading, the S&P 500 had already undercut its 50-day moving average. But the buyers stepped in and quickly reversed the momentum, causing the S&P to pop back above that pivotal level within the first hour of trading, setting in motion a steady uptrend that persisted throughout the day.

On the daily chart of the S&P 500 SPDR ($SPY) below, notice how the benchmark ETF probed just below its closely-watched 50-day moving average before reversing sharply higher:

The reason I suggested the S&P 500 would likely undercut its 50-day moving average was that it is extremely common for the index to do so when it closes so near the exact level of the moving average the prior day.

In this case, $SPY closed less than 0.2% above its 50-day moving average on Tuesday, so it seemed inevitable that banks, mutual funds, hedge funds, and other market-moving players would "shake out the weak hands" (cause traders/investors with bad stop placement to sell their positions while the big boys scoop up those same shares).

Overall, yesterday morning's bullish reversal and subsequent trend day higher was definitely bullish.

In fact, the shakeout below the 50-day MA with instant recovery was a positive sign for the health of the current rally.

Nevertheless, the main stock market indexes may still oscillate in a sideways range for another week or two because a lot of overhead supply was created by the selloff of the past week.

Although impatient traders may prefer stocks to quickly zoom back to new highs again, it is actually healthier for the current rally if the broad market takes a few more weeks to catch its breath.

Practically every solid rally that "sticks" is preceded by the stock/index first building a solid base of consolidation that generally spans around 5 to 8 weeks (stocks are presently on week 5 of the current base).

A base-building pattern is a bit like the foundation of a house; without it, your house will not be solid.

Therefore, even though price action in the stock market may remain choppy and/or stagnant while in consolidation mode, it is always preferable to the NASDAQ or S&P 500 rallying too long without a decent pause along the way (the inevitable price correction is usually much worse in the latter case).

With yesterday's "accumulation day," we now expect new bullish swing trade setups to begin emerging in the coming days. When that occurs, we will be sure to alert subscribing members to new potential stock/ETF trade details in the "Watchlist" section of our stock picking newsletter.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|