| The Wagner Daily ETF Report For September 23 |

| By Deron Wagner |

Published

09/23/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 23

Bearish momentum of last Friday's broad-based stalling action near the highs followed through into Monday's session, causing the main stock market indexes to close substantially lower.

Relative weakness in the NASDAQ Composite continued, as the tech-heavy index fell 1.1%. The Dow Jones and S&P 500 lost 0.6% and 0.8% respectively, pointing to the continued rotation out of the NASDAQ and into large caps (which we pointed out last week).

Again, such institutional rotation is preferable to flat out distribution in which money is heavily rotating out of the stock market in general.

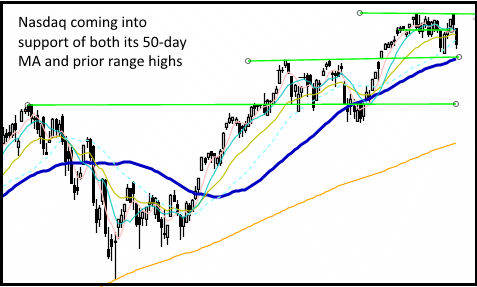

Despite the broad market's negative price action of the past two days, the NASDAQ technically remains in good shape because the index is still above both its 50-day moving average and prior "swing low" from a few weeks ago.

This has resulted in a "base on base" type pattern forming in the NASDAQ:

Overall, it's difficult to be bearish or negative on the uptrend when an index is merely pulling into key intermediate-term support of its 50-day MA.

As long as the NASDAQ holds above its 50-day moving average, the rally remains in good shape. In fact, many "smart money" traders use pullbacks to the 50-day moving averages as low-risk buy entry points.

We also suggest keeping an eye on the performance of $TSLA over the coming week. Since it is a leading stock, it is important that Tesla closes at or around its 50-day moving average by the end of this week as well.

In the case of the NASDAQ, Tesla, and any stock pulling back to a closely-watched level like the 50-day MA, even a one or two-day "undercut" of the 50-day MA is acceptable too.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|