| The Wagner Daily ETF Report For September 22 |

| By Deron Wagner |

Published

09/22/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 22

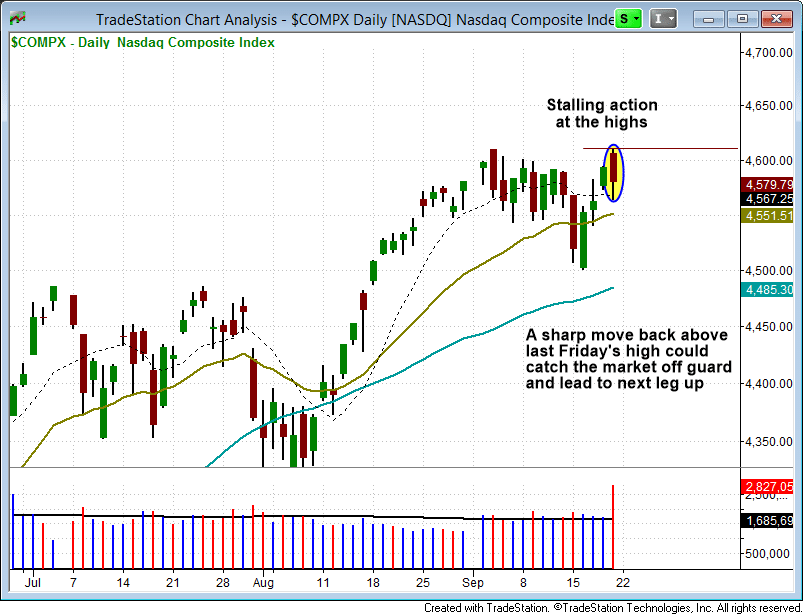

Last Friday's stalling action at the highs in the major averages suggests there could be further weakness this week, or at the very least a few days of chop. That being said, a move above last Friday's high would negate the stalling action and put most averages at new 52-week highs and in trend mode.

Our weekend stock scans did not turn up much in the way of entries on strength (over a range high for example). Most setups were of the pullback variety, with many needing another day or two of consolidation to produce an ideal buy point. A few stocks we are currently watching are: MOBI SMCI GRUB ZEN LEJU NOR ZPIN MACK BLUE GRPO TGTX LOCO. Many of these stocks are fresh IPOs with under a year's worth of trading.

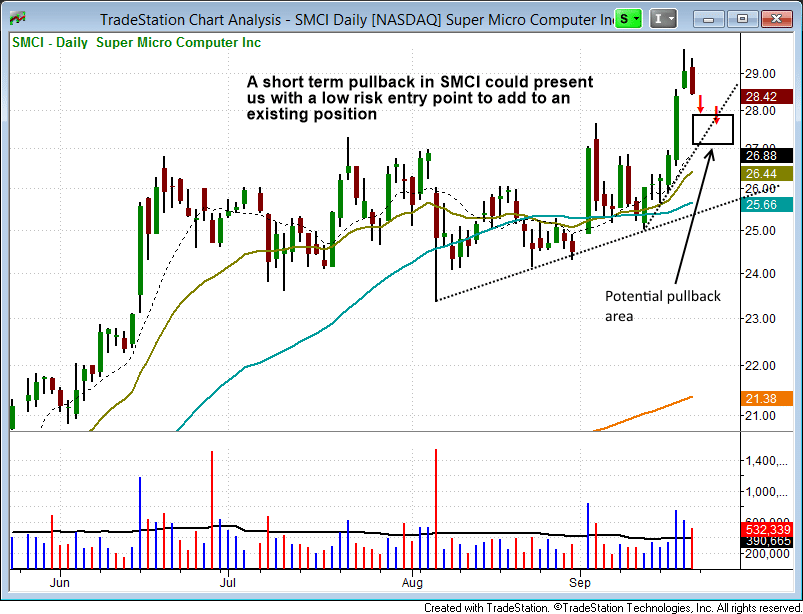

After breaking out from a base on base type formation last week on above average volume, Super Micro Computer ($SMCI) may pull back in for few days IF it is unable to hold above the 20-period EMA on the hourly chart. A pullback to the $27 - $27.50 area could present us with a decent low risk entry point to add to our current long position.

$SMCI does have improving fundamentals, with 91 EPS ranking from IBD and 5 consecutive quarters of strong eps and revenue growth. Although this is a swing trade, the fundamentals are good enough to allow us to hold for a bigger gain, but that will depend on the price and volume action.

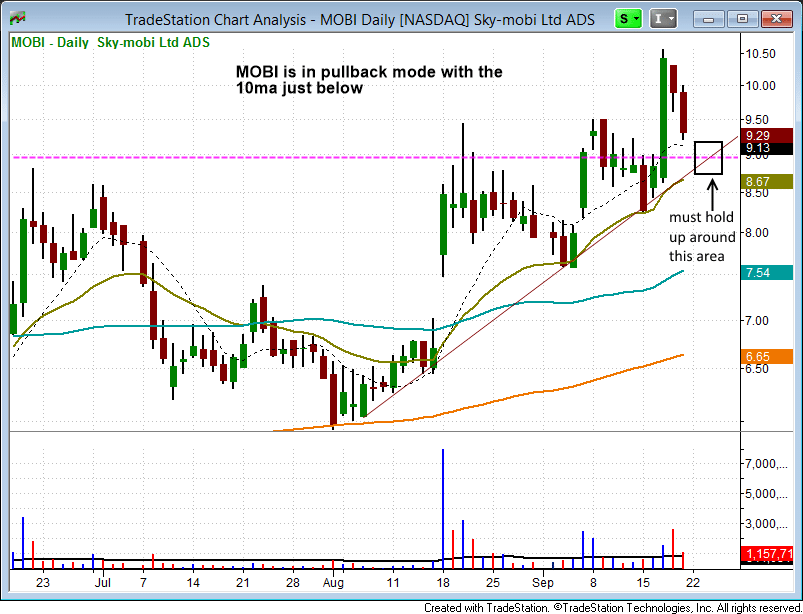

Sky-Mobi ($MOBI) is a Chinese based stock with an explosive breakout during the first quarter of 2014. Since then it has been in consolidation mode, with the price action setting higher highs and lows the past few weeks.

$MOBI may be ready to reverse higher after a 2-day pullback to the breakout pivot and 10-day MA. We are monitoring the action for a potential entry point this week.

Due to the lack of fundamentals and institutional backing, $MOBI is a pure swing trade, meaning that is should be sold into strength after a pop. We do not hold these type of stocks through a pullback after an explosive move up. $TSLA, $FB, $AMBA, and $PANW are examples of stocks that we would hold through a pullback after a strong move up.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|