| The Wagner Daily ETF Report For September 18 |

| By Deron Wagner |

Published

09/18/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 18

The S&P 500 stalled at the prior swing high and sold off late in the session, closing near the middle of the day's range. The Nasdaq Composite also sold off, closing below the declining 10-day MA and off the highs of the day. Unless these averages can quickly push through resistance, the odds favor another week or two of consolidation.

If the resistance holds, then the 50-day MA is still in play for a potential pullback in both the S&P 500 and Nasdaq Composite.

Volume was slightly higher on the NYSE and 5% lighter on the Nasdaq. The higher volume combined with stalling action may hint at minor selling into strength on the S&P 500, but nothing to be too concerned about.

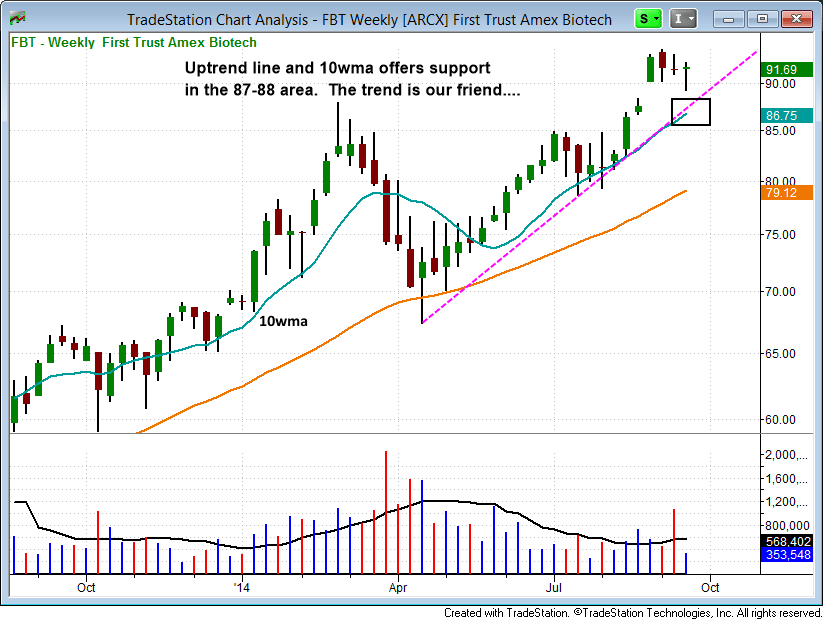

Having already sold half or our position in Biotech ETF ($FBT) into strength for a 9% gain from (83.96 entry), we are prepared to hold the remaining half position with a loose stop below the 10-week moving average and uptrend line, which are currently in the $87 - $88 area.

The trend is our friend ---- so we will stick with the position as long as it remains above the 10-week MA, unless it puts in an explosive move to the upside, allowing us to sell into strength.

On the stock side, the pullback entry in $MLNX triggered during an afternoon pullback, finding support at the rising 20-period EMA on the hourly chart. With the breakout holding above 43.50 the past two days, we now look for the price action to close out the week strong on a weekly chart.

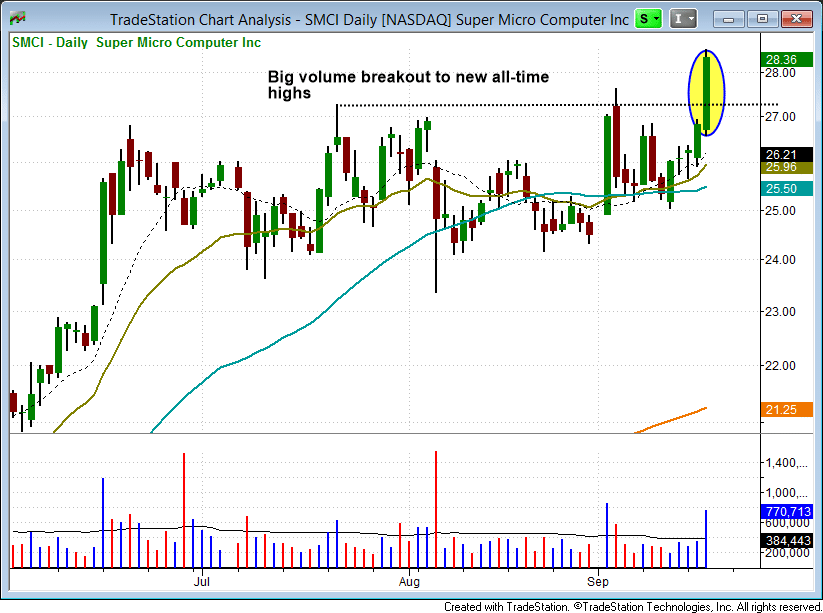

In The Wagner Daily newsletter, our model portfolio is currently long Super Micro Computer ($SMCI), which broke out to a new all-time high on heavy volume yesterday. If there is no immediate follow through, then we could potentially see a few days of chop to allow the 20ema on the hourly to catch up after a 15% move off support of the 50-day MA.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|