| The Wagner Daily ETF Report For September 16 |

| By Deron Wagner |

Published

09/16/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 16

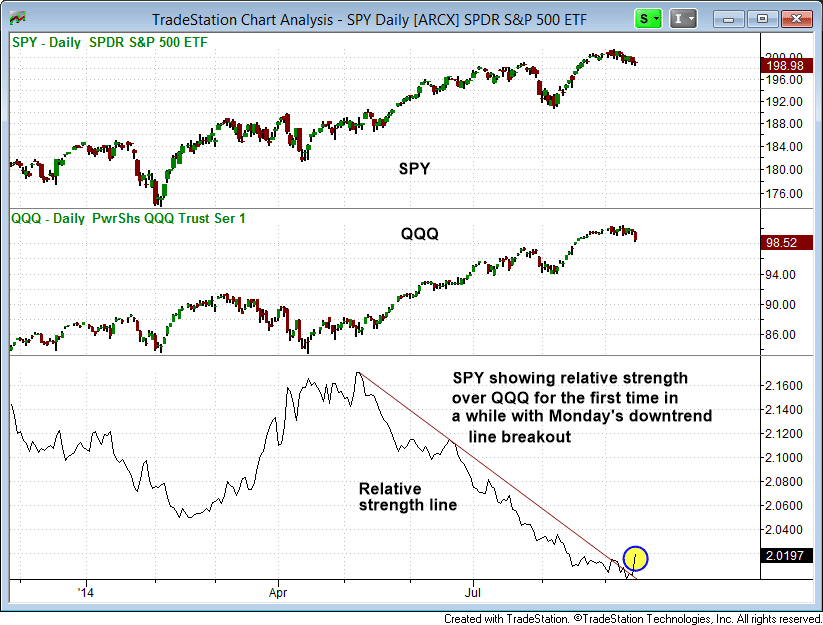

High beta stocks were hit hard on Monday, with the Nasdaq Composite closing -1.1% lower while the S&P 500 closed flat. The divergence in performance between the two major averages may suggest that funds are beginning to rotate out of extended, high beta names and into slower moving stocks in anticipation of a broad market correction (which could take place within a few weeks or months).

The relative strength in $SPY produced a downtrend line breakout in the relative strength line vs $QQQ. This was the first sign of relative strength for the S&P 500 in a few months:

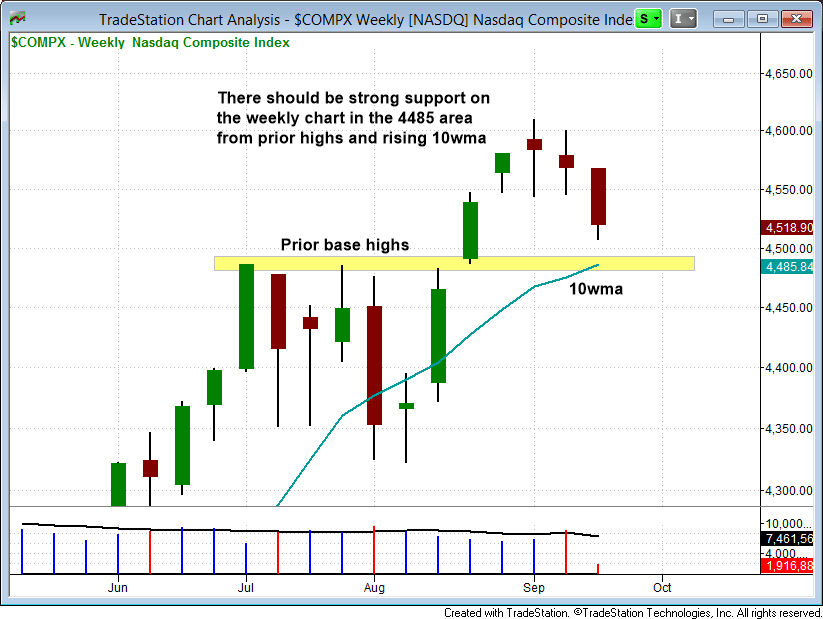

Monday's higher volume selling produced a second straight day of distribution in the Nasdaq Composite. The distribution days are beginning to cluster, with three of the past five sessions qualifying as distribution.

On the weekly chart, there is support around 4485 from prior base highs and the 10-week moving average, which is less than 1% away from Monday's close:

Russell 2000 ETF ($IWM) closed below the 50 & 200-day moving averages on Monday. If $IWM is unable to retake the 200-day MA, then it would place additional pressure on the current market rally.

Given the weakness in tech stocks, Super Micro Computer ($SMCI) held up well and closed near the highs of the day. With a 96 rs ranking and 91 eps ranking, $SMCI is both fundamentally and technically solid. A break of the two-day high could lead to a move to new highs in short order IF the market cooperates or $SMCI continues to show great relative strength.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|