| The Wagner Daily ETF Report For September 4 |

| By Deron Wagner |

Published

09/4/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 4

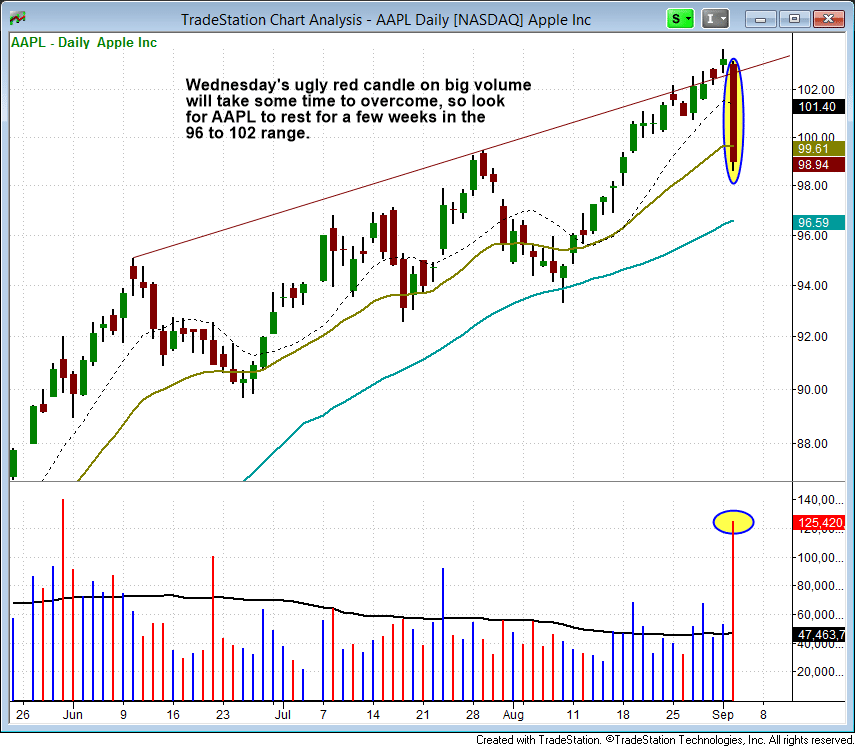

The Nasdaq Composite sold of on higher volume Wednesday, registering a distribution day and producing an ugly reversal candle. However, the price action remains above the 10-day MA, and Wednesday's session was the first sign of distribution in a few weeks.

The S&P 500 failed a breakout attempt above the current range high and sold off, closing in the bottom 25% of the day's range. Since volume was lighter on the NYSE, the stalling action did not qualify as churning, but the stalling action is noteworthy.

Both the Nasdaq and S&P 500 are vulnerable to further selling if the 10-day MA does not hold. But as we have seen over the past few years, the price action can remain "overbought" and above the 10-day MA for 20 to 30 sessions or more before slowing down. As such, our market timing model remains on a "buy" signal.

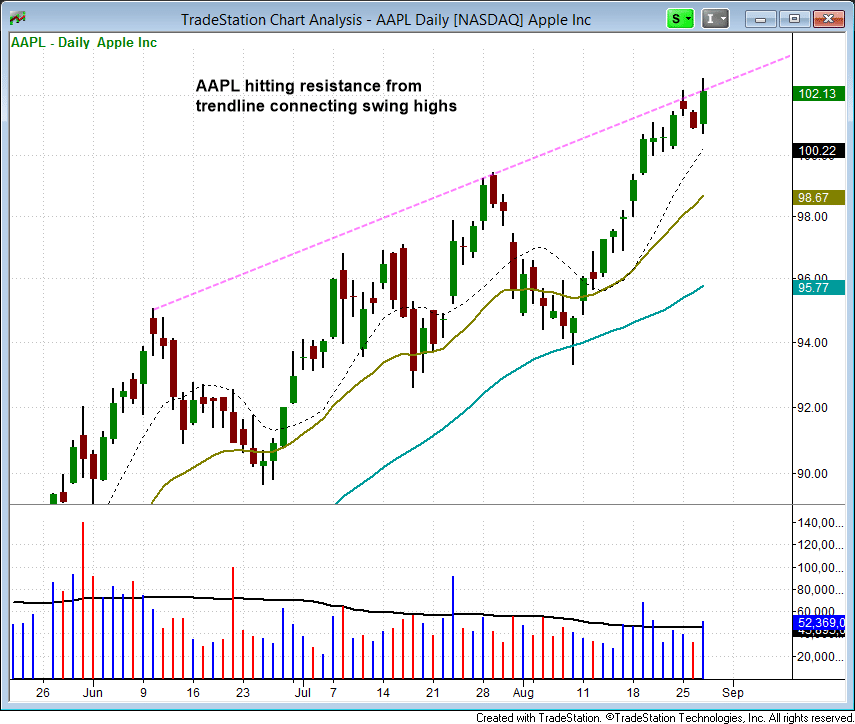

In the August 28 report of The Wagner Daily, we mentioned the possibility of $AAPL pulling back in after running into resistance from a major prior high and a trendline connecting recent swing highs. This was the chart we showed at the time:

After struggling to push through the trendline for a few days, $AAPL indeed broke down on heavy volume Wednesday, which will probably lead to a few weeks of rest for the Nasdaq 100 as well:

Although the timing model remains on a buy signal, we haven't seen much in the way of low-risk buy setups emerge from our scans this week. When this happens, we prefer to lay low and patiently wait for new setups to develop rather than force the issue just because the market is in trend mode. Proper setups are everything!

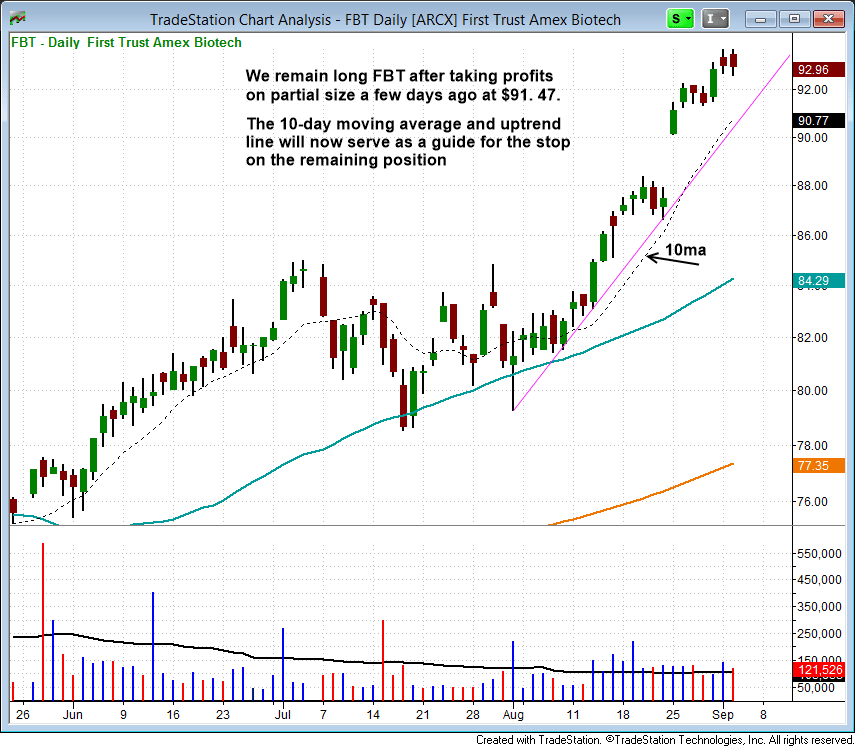

On the ETF side, our best performing open position has been Biotech ETF ($FBT), which remains in a strong uptrend on the hourly chart (still above the 20-period EMA on the hourly). We sold partial size of $FBT into strength at $91.47 a few days ago, and will now trail a stop on the remaining shares:

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|