| The Wagner Daily ETF Report For September 3 |

| By Deron Wagner |

Published

09/3/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For September 3

The Nasdaq Composite and Nasdaq 100 continue to push higher while the Dow and S&P 500 have chopped around in a tight range the past few days. Tuesday's rally in the the S&P Midcap 400 stalled just below the prior swing high before reversing to close in the middle of the day's range.

The S&P 400 is straight up off the lows, forming a V-shaped pattern on the daily chart. The lack of consolidation during the move up suggests that the chart may need a few weeks of basing at or around the prior swing high before heading signficantly higher.

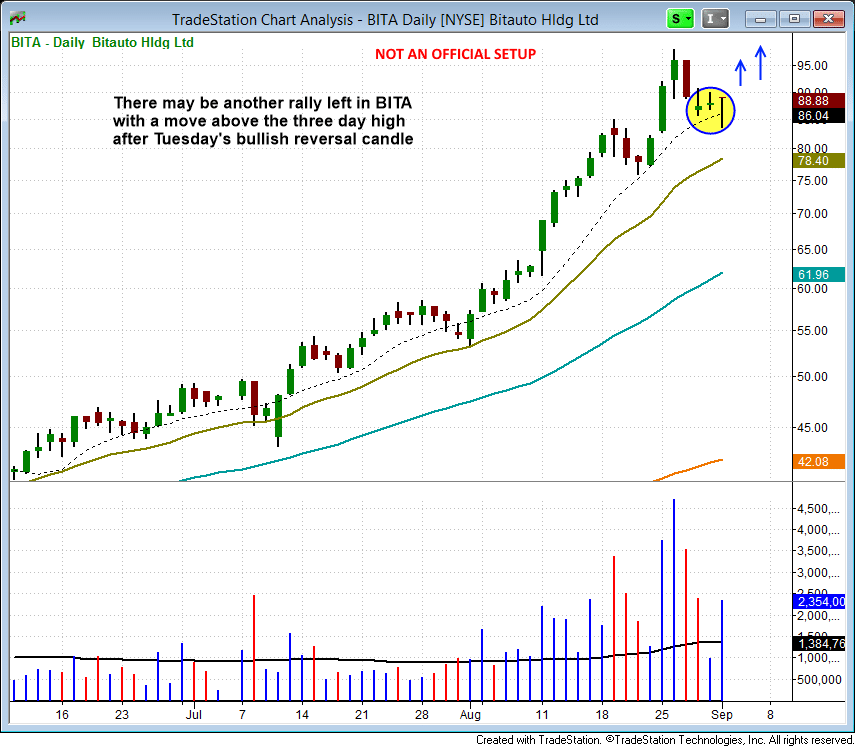

$BITA is not an official buy setup, but a move above the three day high could lead to new highs in short order, as the price action continues to hold the rising 10-day MA. The stop for such a trade would be below Tuesday's low, making it a go or no go type of trade (we call it a GONG setup).

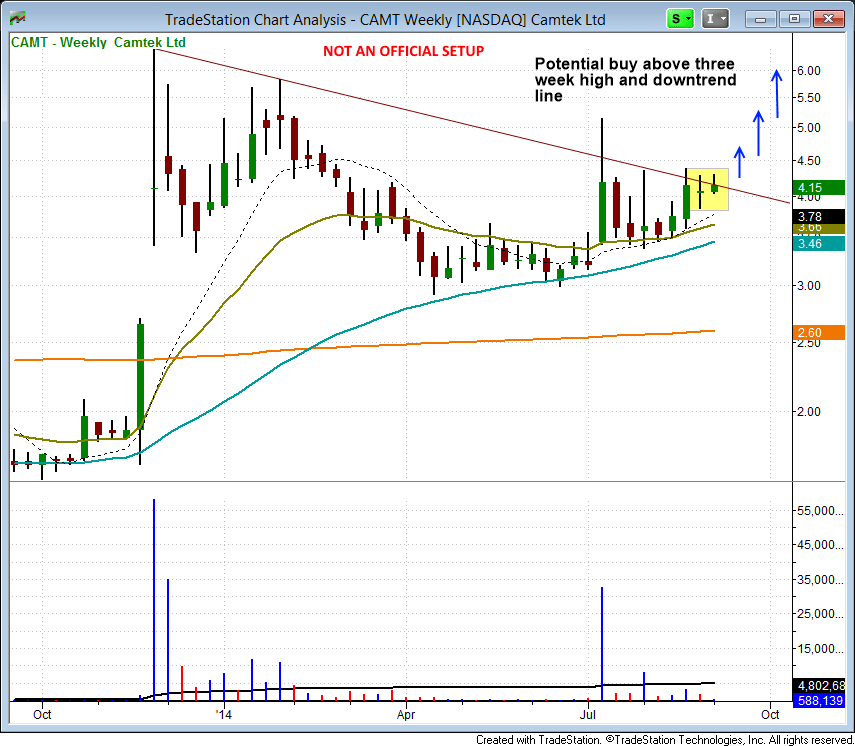

Another non official setup we are monitoring is in Camtek ($CAMT), which is sitting just below a two-week high and the weekly downtrend line. Note the big volume spike in early July. A move above $4.30 could generate some buying interest:

Our stock scans continue to show plenty of bullish chart patterns in the market, which is a good sign, but there are no new official setups tonight. As always, we are waiting for new low-risk entry points to emerge, while maximizing the profits of our existing winning positions.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|