| The Wagner Daily ETF Report For August 25 |

| By Deron Wagner |

Published

08/25/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 25

Stocks closed out the week with a pick up in volatility, especially in the Nasdaq Composite during the first two hours of trading on the intraday charts. After an extended move off the lows, most averages could use a few days of rest, allowing the 10-day MA to catch up.

The Russell 2000 is the only index still struggling with the 50-day MA, but the price action now has support from a rising 10-day MA and 20-day EMA, and is still above the 200-day MA.

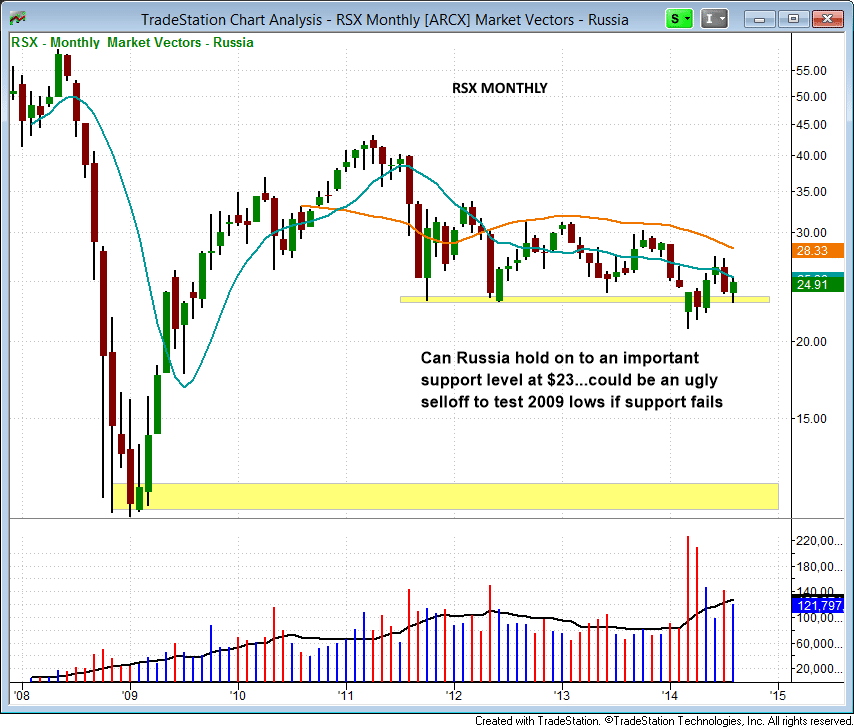

On the ETF side, Russia ETF ($RSX) may be in big trouble if it can't hold on to a critical support level at $23 on the monthly chart. This is not something we are monitoring for an entry now.

As the chart below details, $RSX could be in for a nasty fall to the lows of 2009, thereby making it a potential short selling candidate in the future.

As far as price action in leading stocks, breakouts continue to work and new setups are emerging which is a good sign. Of course some stocks that were once strong have fallen apart, but that is to be expected so late in a bull market rally.

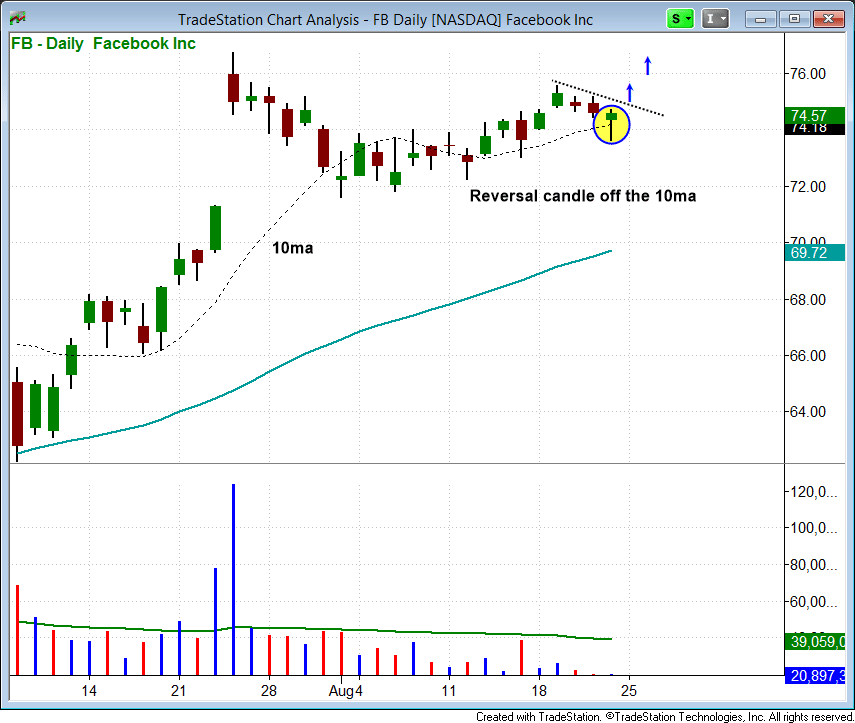

Facebook ($FB) closed with a positive reversal candle last Friday after undercutting the 10-day moving average. This minor shakeout may be the kick in the rear the price action needs to get going after a lazy move off $72 in mid-September.

We are placing $FB on today's watchlist. Regular subscribers of our nightly report should note our exact buy trigger, stop, and target prices in the "Watchlist" section of today's issue.

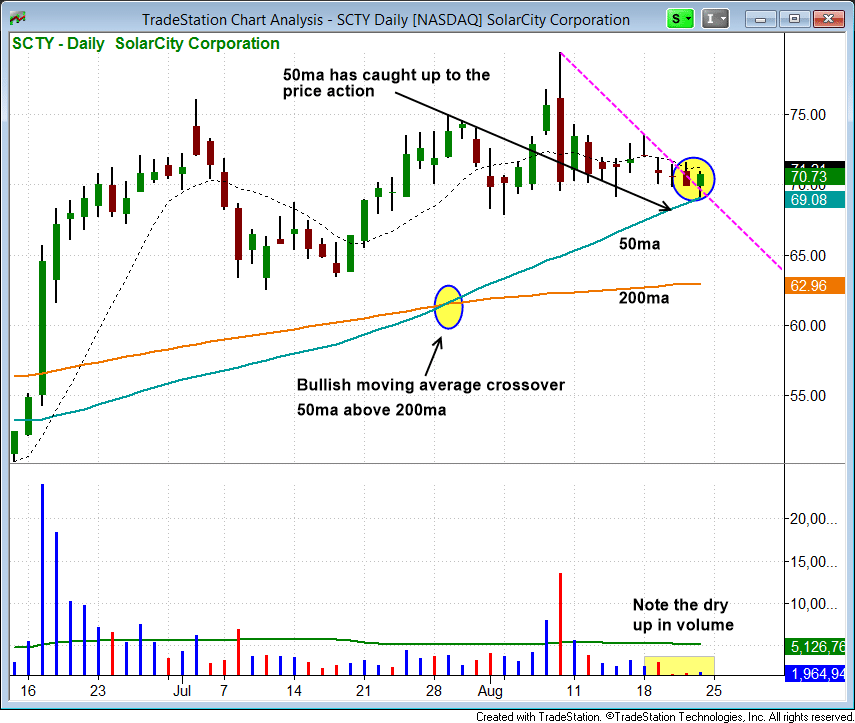

SolarCity has been in consolidation mode for a few weeks, allowing the 50-day MA to cross above the 200-day MA and catch up to the price. Since the ugly reversal candle on 8/8, the price and volume has been pretty quiet, with the volume really during up last week (last week's volume was lightest volume since late December of 2013).

$SCTY may be ready to push higher here, but could also put in a shakeout candle below the 50-day MA before doing so. Either way, the price action should eventually move higher and bust through $80.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|