| The Wagner Daily ETF Report For August 21 |

| By Deron Wagner |

Published

08/21/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 21

The Nasdaq Composite stalled above the prior day's high and basically closed flat on the day, while the S&P 500 closed just below the highs of the range. It appears that these averages are a bit overbought in the short-term, but could certainly continue to run higher.

Ideally, we'd like to see the market consolidate for a few days in a fairly tight range, or pull back in with a slight pick up in volatility to shake out weak longs. These shakeouts often create the bullish reversal candles we look for in a low-risk entry point.

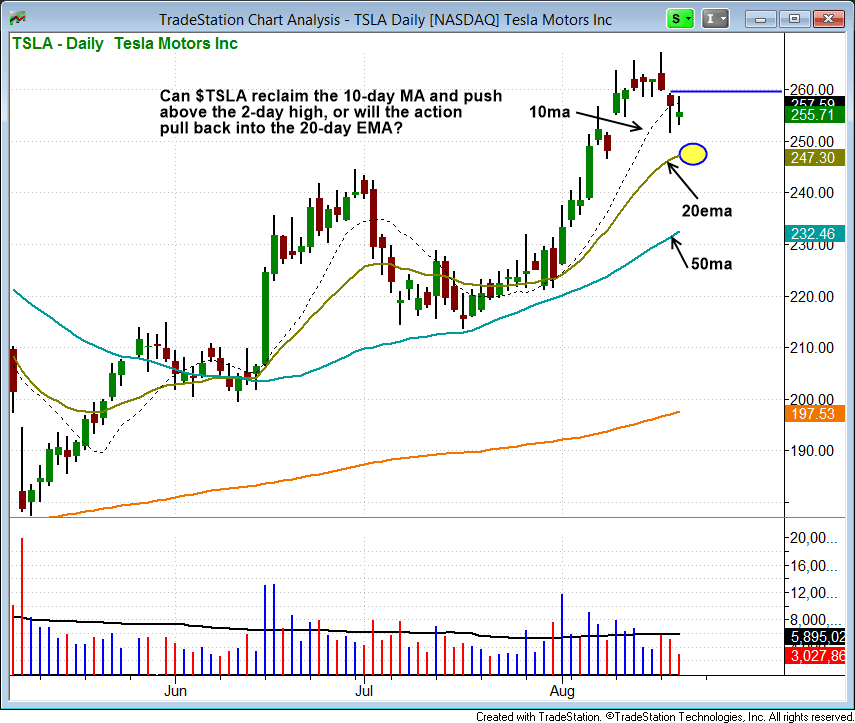

Tesla Motors ($TSLA) closed below the 10-day MA on Wednesday, but volume was light. The 10-day MA is our line in the sand for a very strong uptrend. Stocks above the 10-day MA should be left alone, while stocks that break the 10-day MA may need some time to rest and digest the last move up.

We are placing $TSLA on today's Wagner Daily watchlist as a potential swing trade entry. Subscribers should note the Watchlist section of today's report for exact buy trigger, stop, and target prices. The setup either works out right away or triggers our stop for a small loss (it is a go or no go situation - G.O.N.G.).

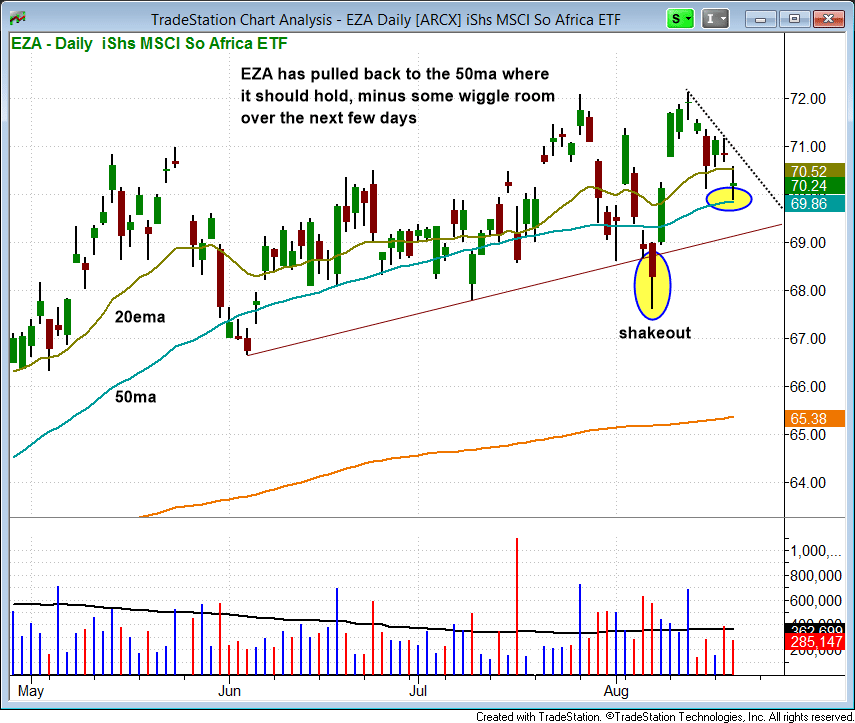

On the ETF side, we have one new buy setup in iShares Africa ETF ($EZA), which has recently pulled back to the 50-day MA after stalling at $72. We are looking to enter $EZA off the 50-day MA with a stop below the shakeout candle of 8/7.

The chart still has decent momentum, with the 10-day MA above the 20-day EMA, and both of these averages above the 50-day MA. Again, please see today's watchlist for trade details.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|