| The Wagner Daily ETF Report For August 20 |

| By Deron Wagner |

Published

08/20/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 20

Stocks continued to push higher on Tuesday, led by the Nasdaq Composite which has closed up in 7 of the past 8 sessions. After blasting through resistance at 1960, the S&P 500 is now less than 0.5% off the 52-week high. The Dow Jones and Russell 2000 finally joined the other averages and recaptured the 50-day MA.

Our scans did not turn up much in the way of low risk setups on the ETF or stock side, and that is due to the recent run up, as most stocks are extended in the short term and will need to rest for a bit to produce low risk entry points.

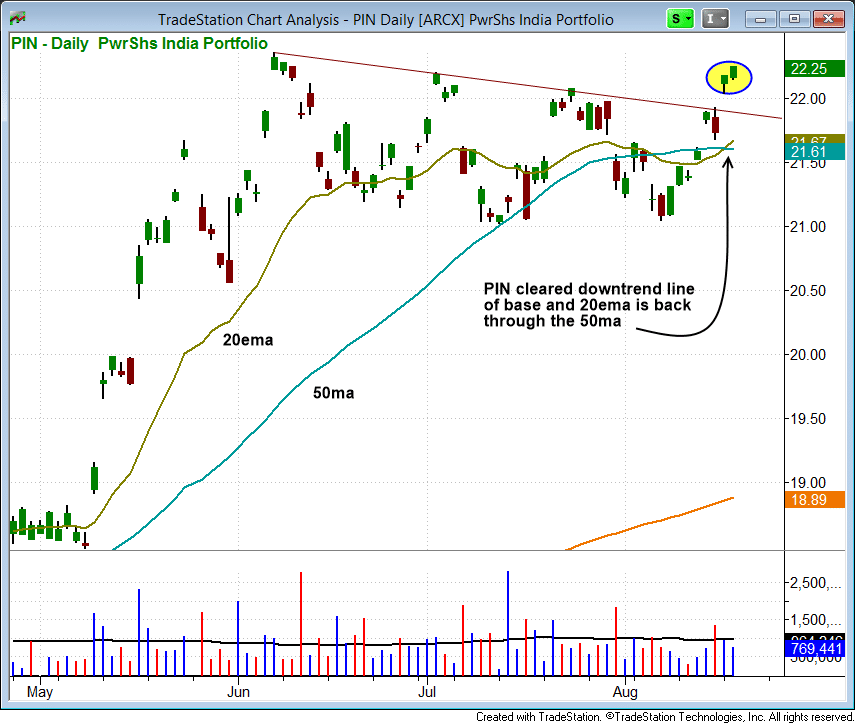

We do have one new buy setup on the ETF side in PowerShares India ($PIN), which cleared the downtrend line of the current consolidation on Monday after finding support at the prior swing low on 8/7. Volume picked up on a test of the 50-day MA on 8/15, and was just above average the following day on the 8/18 breakout.

We are placing $PIN on today's watchlist with a target just below $26, where there is resistance from prior highs in 2008 and 2010. Subscribing members of The Wagner Daily should note our exact entry, stop, and target prices in today's report.

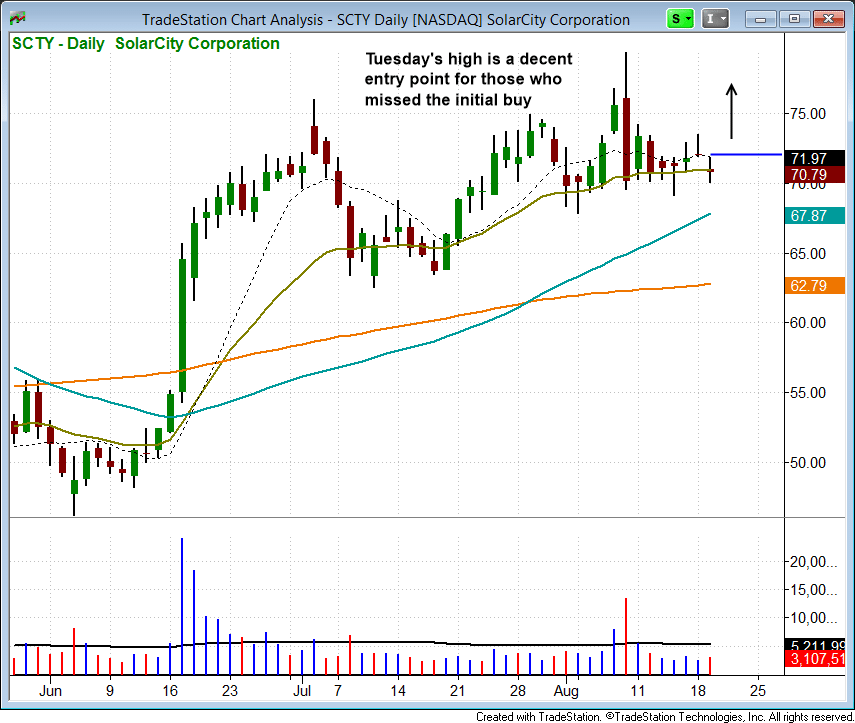

Yesterday's gap down did produce a potentially low risk entry point in SolarCity ($SCTY) over Tuesday's high for those who missed our original entry (use stop that is currently in place for $SCTY on today's watchlist).

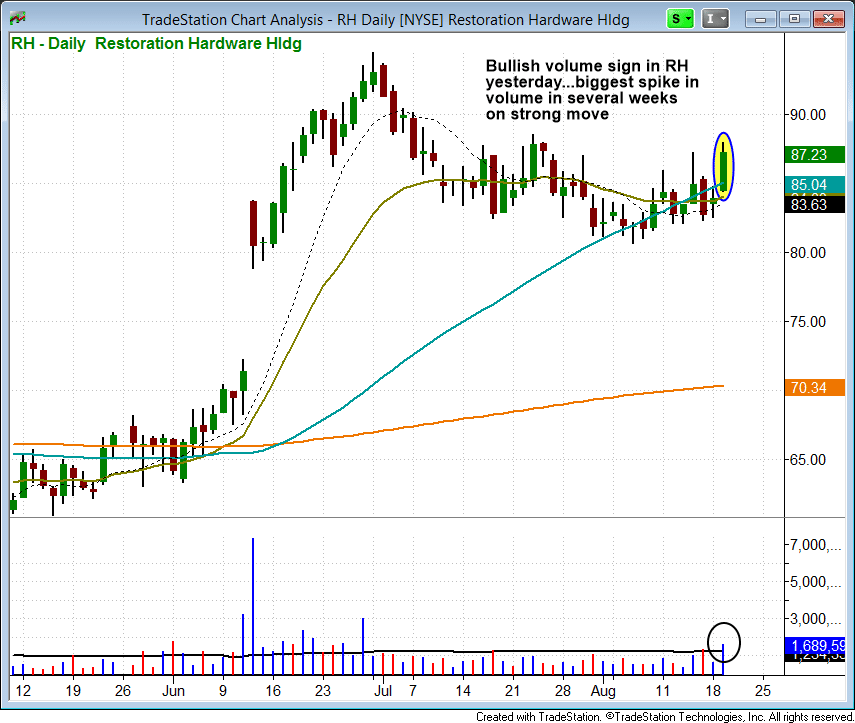

Restoration Hardware ($RH) confirmed our entry with a strong price and volume move on Tuesday. The spike in volume was the biggest in several weeks and is a bullish sign. We will look to add to the position if possible over the next week or two.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|