| The Wagner Daily ETF Report For August 15 |

| By Deron Wagner |

Published

08/15/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 15

Following through on Wednesday's accumulation day, stocks rallied higher across the board, with a few major averages closing in on major resistance. The S&P 500 stopped just shy of the 50-day MA and prior range lows, while the Nasdaq Composite is now less than 1% below its 52-week high.

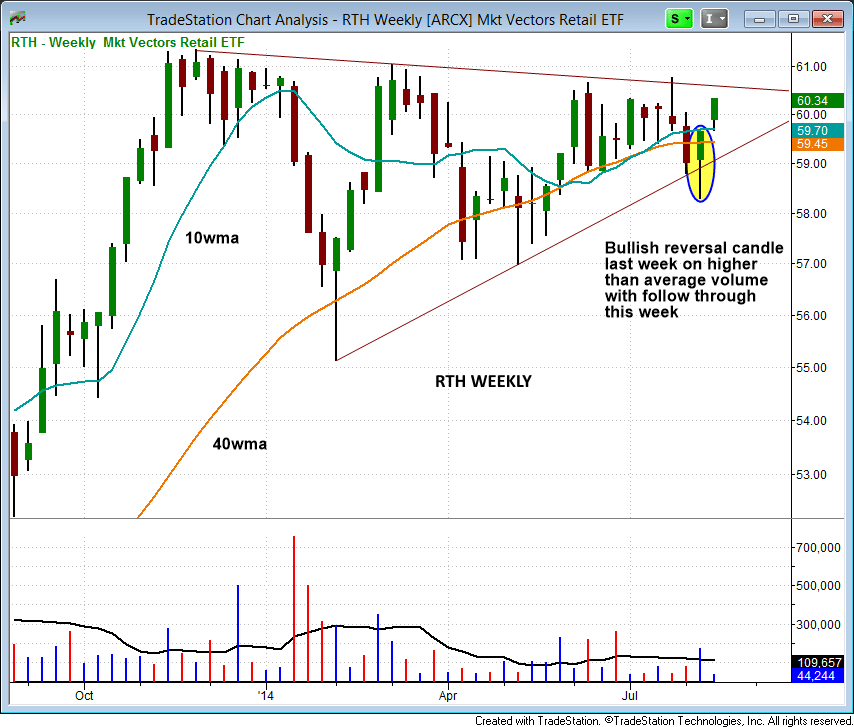

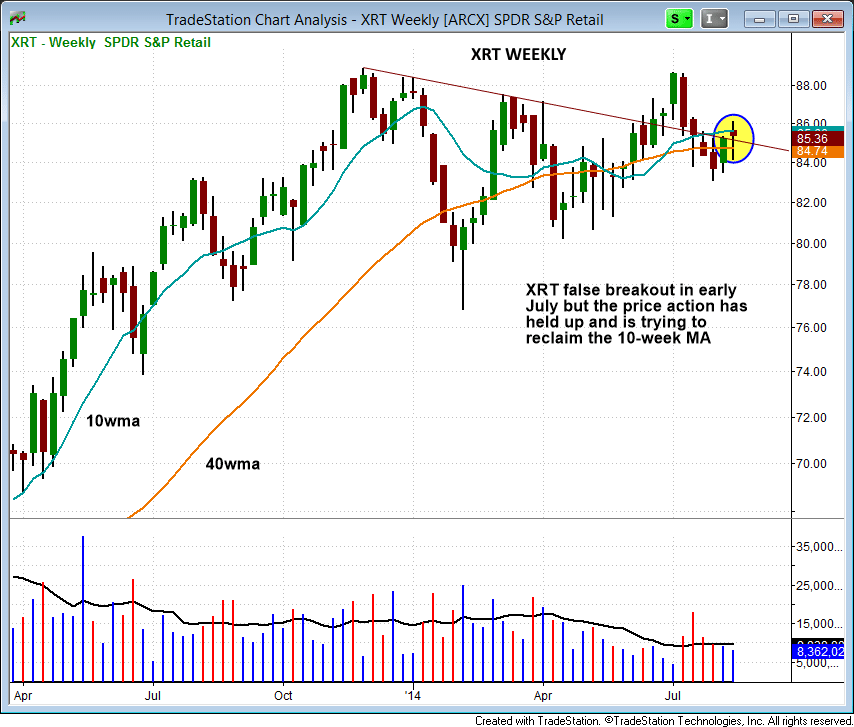

After an ugly selloff in January, retail ETFs $XRT and $RTH have spent the past the past seven months in base-building mode and have tightened considerably as of late.

$RTH has reclaimed the 10 and 40-week MAs after following through on last week's bullish reversal candle on higher volume. $RTH is long longer a heavily traded ETF, but the chart does show the potential for a major breakout in big cap retail stocks:

A more well rounded retail ETF is $XRT, which put in a false breakout in early July but failed to breakdown below the 40-week MA. $XRT is now back above the 40-week MA but has yet to reclaim the 10-week MA.

On the daily chart (which is not pictured below), the 10-day MA has turned up to provide support after trending lower for 20 bars in a row.

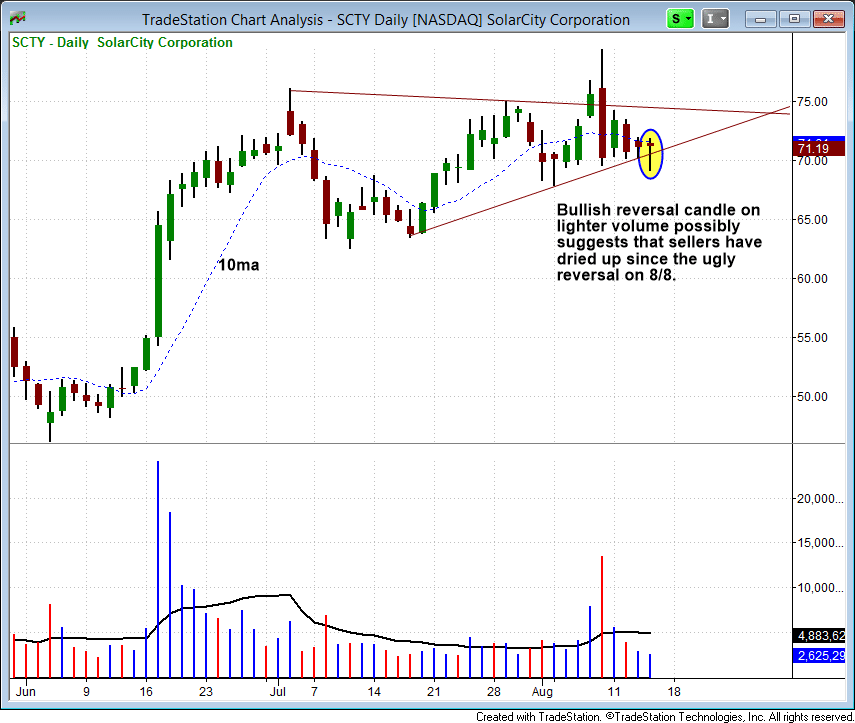

On the stock side, we have one buy setup remaining in SolarCity, but please note the new stop price below Thursday's low. A move above the 10-day MA and yesterday's high is the buy pivot at $72.

Hopefully the remaining weak longs were shaken out Thursday morning along with those who sold on 8/8, which would clear the way for $SCTY to run higher for a few days at the very least.

The $SCTY setup is definitely a go or no go (GONG) situation, which is why we are keeping the position size small.

The price action of stocks breaking out to new highs has been good thus far, with most breakouts working and holding on to gains. How recent breakouts react on a pullback should provide us with more clues, but we are happy with the action overall.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|