| The Wagner Daily ETF Report For August 11 |

| By Deron Wagner |

Published

08/11/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For August 11

The major averages closed with solid gains across the board last Friday, but the move was not confirmed by volume (NYSE and Nasdaq volume fell short of Thursday's pace). The volume pattern in the NYSE and Nasdaq remains bearish.

It is possible that the S&P 500 could rally for a few days, but given the heavy selling over the past few weeks, we would expect any rally to be short-lived and followed by a test of the recent swing low (or potentially the 200-day MA).

The Nasdaq Composite is the only major index still trading near the 50-day MA. Although it has shown solid relative strength, will it be able to hold the 50-day MA if the S&P 500 heads lower after a short-term bounce?

Nasdaq leadership for the most part is holding up. There have been a few breakdowns and leadership has narrowed, but there are still a handful of quality stocks holding up near 52-week highs.

Our timing model remains in "neutral" due to the relative strength of the Nasdaq. As such, an ugly breakdown below the 50-day MA in the Nasdaq would send the model into "sell" mode. However, if the Nasdaq is able to hold on to the 50-day MA and the market can gain some traction with a few weeks of base building, the model could potentially shift back into "buy" mode.

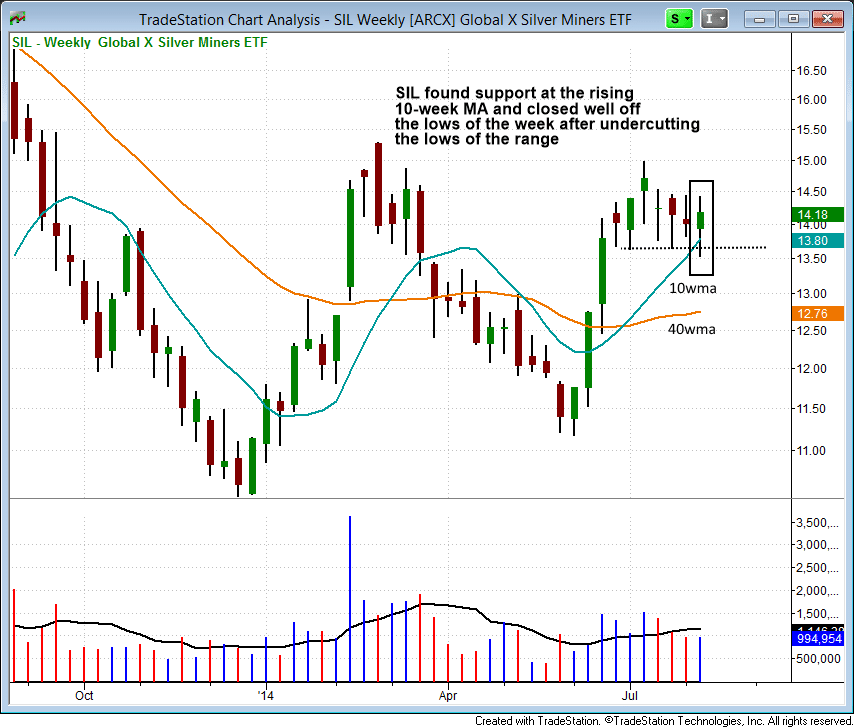

On the ETF side, the weekly charts of gold and silver mining ETFs ($GDXJ) and (SIL) look pretty good, especially with last week's bullish reversal candle off the rising 10-week moving average. See last Friday's commentary for the writeup on Gold Miners ETF ($GDXJ).

Silver Miners ETF ($SIL) has settled into a tight trading range on declining volume over the past four weeks. Last week's low undercut the lows of the range and the rising 10-week MA before reversing to close near the highs of the week. The bullish reversal presents us with a low risk entry point. Subscribers of our nightly ETF and stock pick newsletter should note today's report for our exact buy trigger, stop, and target prices for $SIL trade setup:

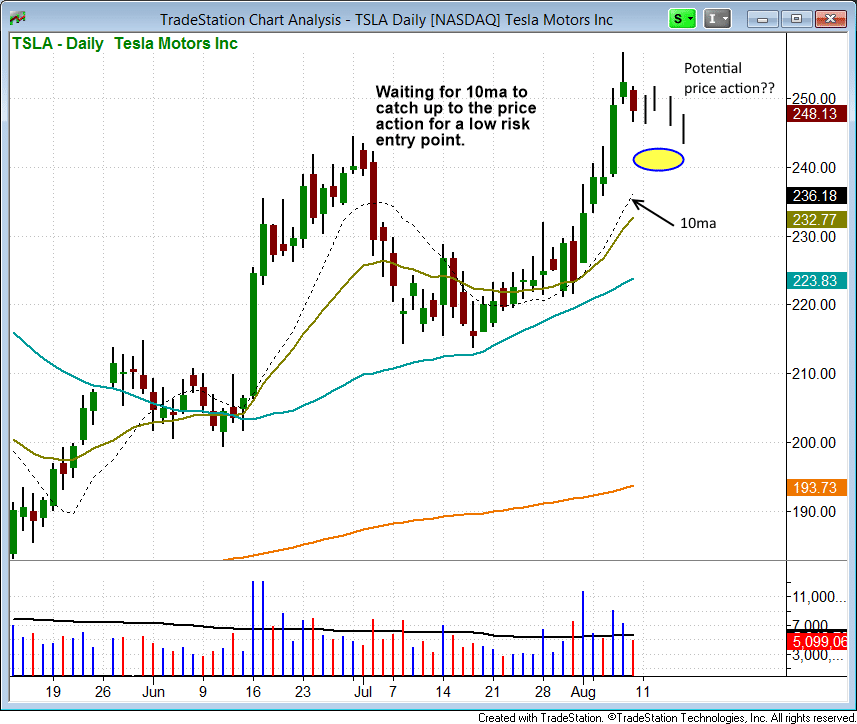

As for leadership stocks, we are currently monitoring Tesla Motors ($TSLA) for a pullback entry on a test of the rising 10-day MA (if one develops). Since market conditions are not ideal, a pullback to the 20-day EMA could also be in play if the 10-day MA does not hold. We will have to see how the action plays out during the pullback:

We do have one new setup on today's watchlist in Twitter ($TWTR), which has pulled back in from a recent earnings gap up on lighter volume to the 10-day MA. Again, subscribing members should note today's Wagner Daily watchlist above for full trade details.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|