| The Wagner Daily ETF Report For July 29 |

| By Deron Wagner |

Published

07/29/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 29

Stocks fought off morning weakness and closed well off the lows of the session, which produced bullish reversal candles in most major averages.

Although it was officially not an accumulation day in the S&P 500 or Nasdaq Composite, with both averages basically closing flat, it felt like an accumulation day as buyers stepped in on weakness after shaking out the "weak hands" in the morning session.

All major averages basically held on to key support levels by the close. As mentioned in yesterday's report, S&P Midcap 400 was able to find support off the backside of the downtrend line at 1,400.

Of all the midcap based ETFs, iShares Russell Midcap Value ($IWS) has the best-looking chart, showing relative strength against the S&P Midcap 400 ETF ($MDY), which just undercut the 50-day MA.

On the daily chart, the moving averages in $IWS are in better shape than $MDY with the 20-day EMA sideways in $IWS and drifting lower in $MDY. Both 50-day MAs are in an uptrend, but the price action in $IWS set a higher low through July while $MDY set a lower low:

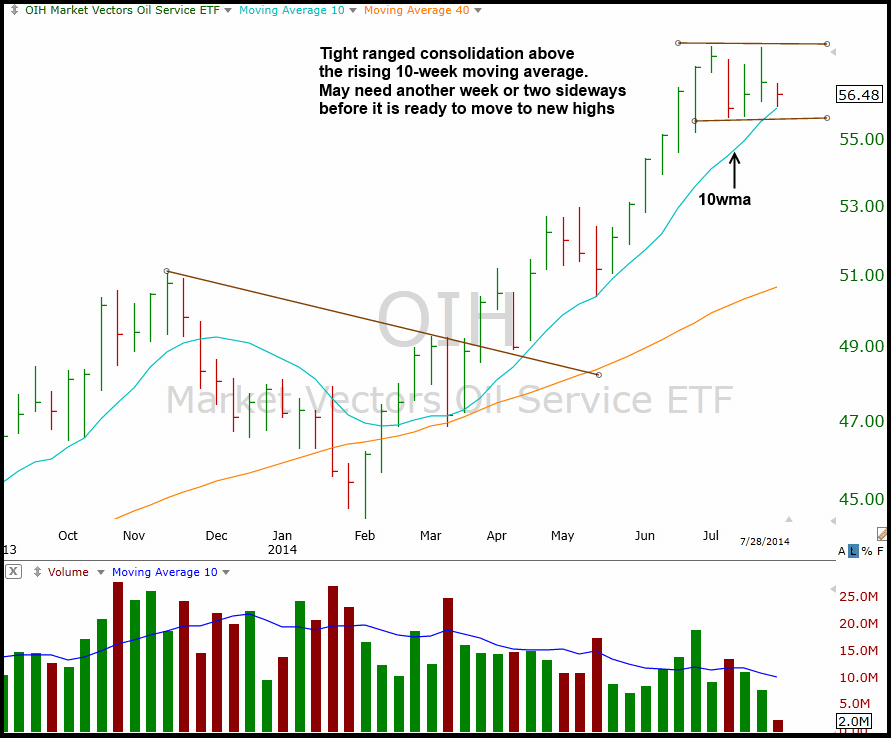

After a strong breakout above $50, Market Vectors Oil Service ETF ($OIH) has been in consolidation mode the past few weeks, forming a flat base above the rising 10-week MA. The price action looks like it may need another week or two of consolidation, with a potential undercut of the 10-week MA to wash out some weak hands. We are patiently waiting for a low-risk buy entry to emerge:

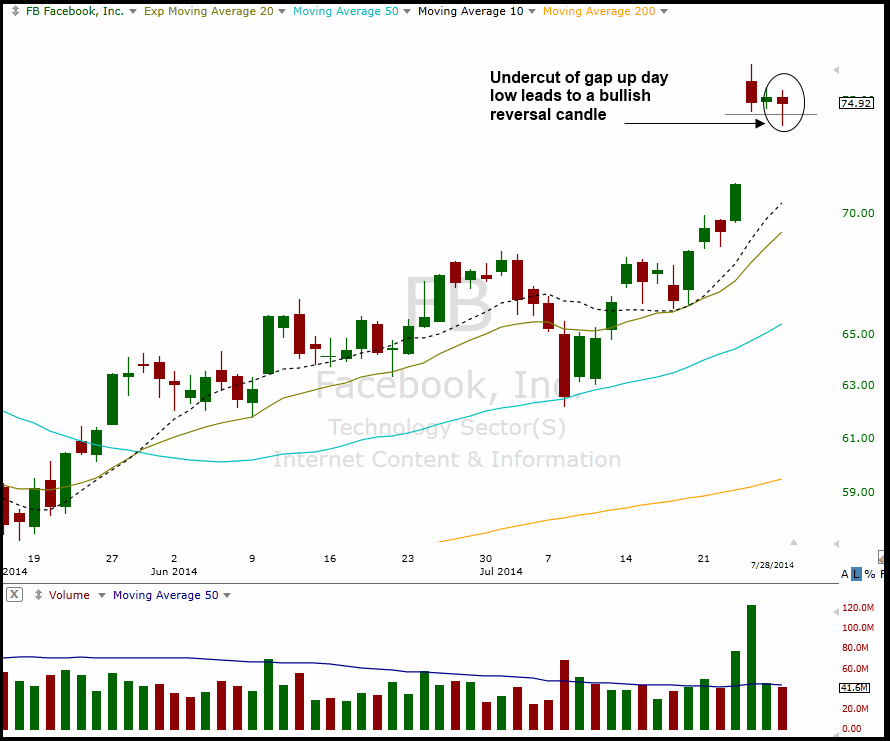

On the individual stock side, we have one new buy setup in Facebook ($FB), which undercut the low of the gap up bar and reversed to close near the highs of the session:

We plan to establish a quarter position in $FB and eventually add to the position on a pullback to the rising 10-day MA or on a breakout from a short-term pause.

Since we are placing both $FB and $IWS on today's Wagner Daily watchlist, subscribing members should note our exact buy trigger, stop, and target prices for these setups in today's report.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|