| The Wagner Daily ETF Report For July 16 |

| By Deron Wagner |

Published

07/16/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 16

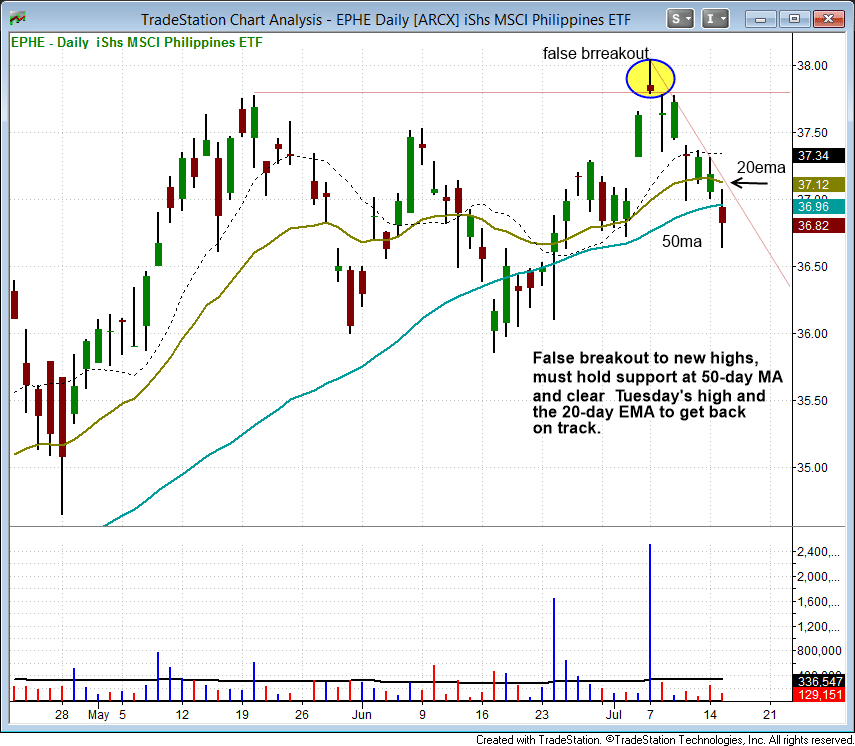

A recent false breakout in a current long position in iShares Philippines ($EPHE) has led to a pullback to the rising 50-day MA. A three to five bar shakeout is normal after a false move to new highs, but the price action should hold up here for the setup to remain intact. The longer it takes $EPHE to reclaim the 50-day MA the less bullish we are on the trade:

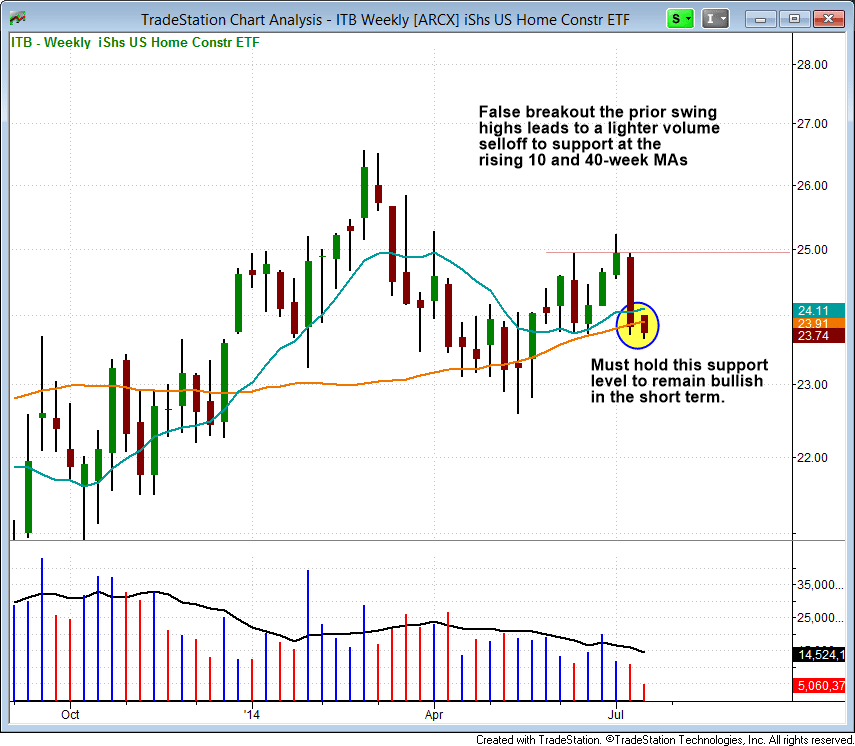

Our current long position in Dow Jones US Home Construction ($ITB) has also pulled back in after a failed breakout above a prior swing high. Although last week's candle was wide, volume did not pick up.

The 10-week MA is still pointing higher, so if $ITB can hold the 40-week MA the setup will remain intact. A breakdown below the 40-week MA would signal that the pattern needs more time to develop before heading higher:

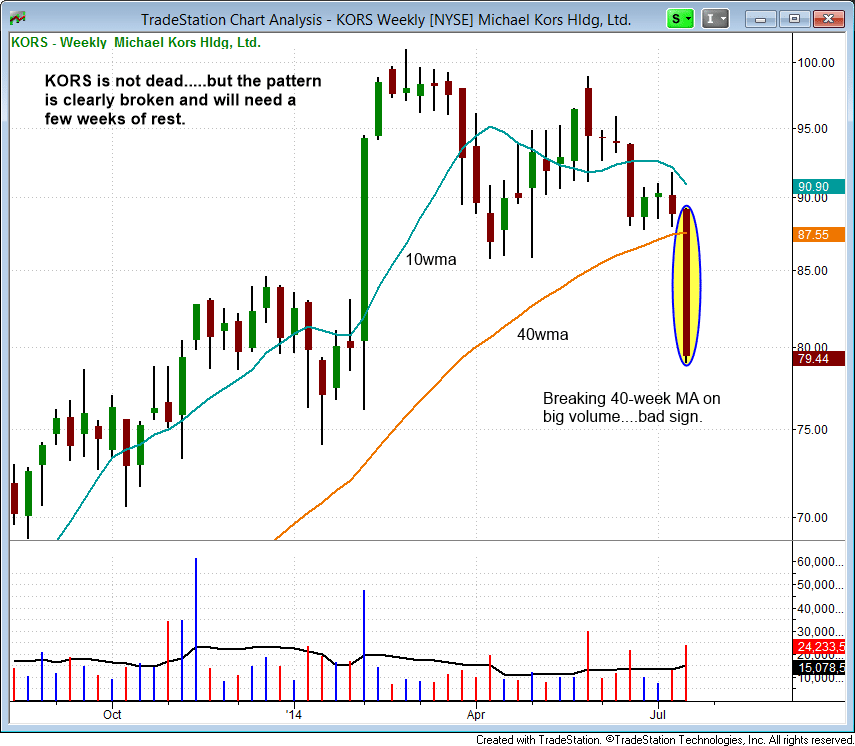

Michael Kors ($KORS) is in bad shape after breaking the 40-week MA on heavy volume Tuesday. This setup is clearly no longer in play and will take several weeks of consolidation to work off this week's selling, especially if it closes near the lows of the week. Do not attempt to catch a falling knife here. How retail stocks react over the next two weeks to $KORS selling will be key.

There are no new swing trade setups on today's stock watchlist as our scans have dried up a bit lately, especially with so many stocks reporting earnings in late July/ early August. The $LEAF and $OVTI buy setups are still live on the Wagner Daily watchlist from yesterday.

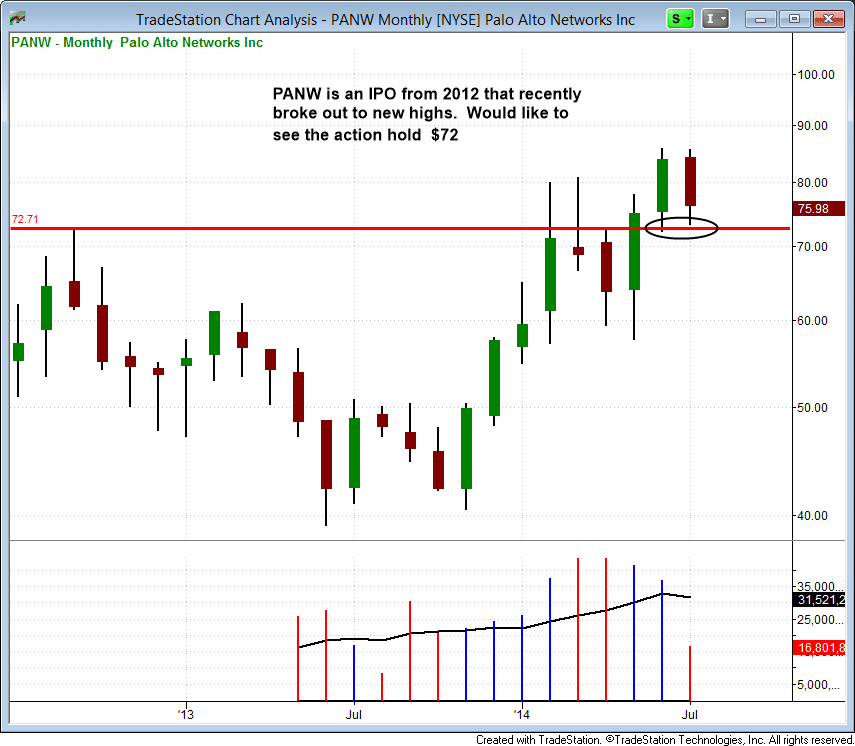

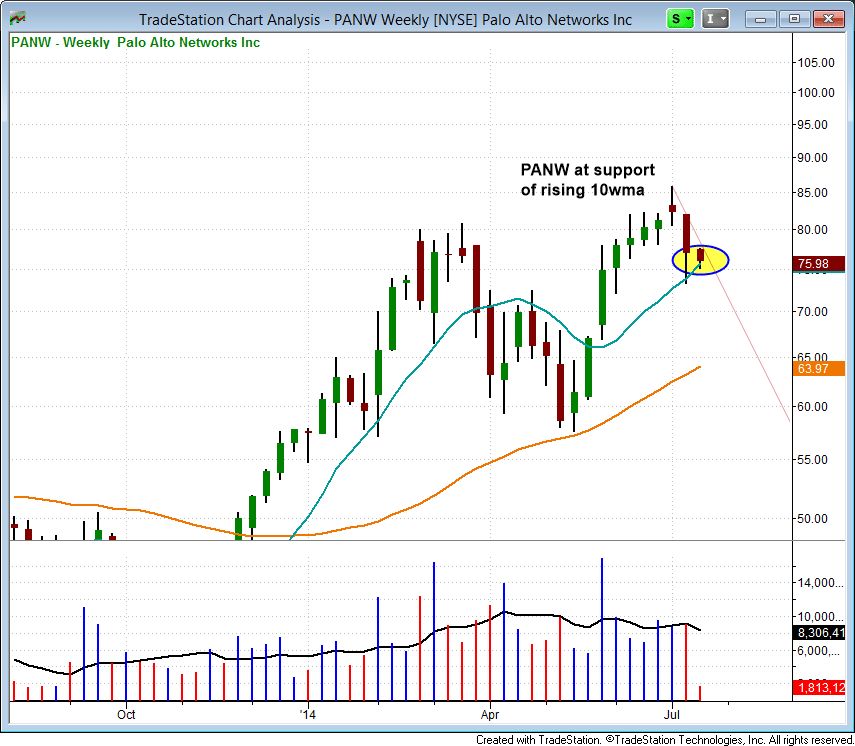

One setup we are monitoring is a potential pullback buy off the 10-week moving average in Palo Alto Networks ($PANW), which is a fairly recent IPO from mid-2012 that recently broke out to new highs on big volume:

$PANW ran to new highs after forming a cup with no handle type pattern. There may have been a handle just before the breakout (on a daily chart), but it wasn't ideal and the move to new highs failed. With the price action pulling back into the 10-week MA, $PANW may present us with a low risk entry point later this week or early next week:

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|