| The Wagner Daily ETF Report For July 3 |

| By Deron Wagner |

Published

07/3/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 3

Stocks chopped around in a tight range for the most part, with small and mid-cap stocks showing a bit of relative weakness to big cap stocks. The small cap Russell 2000 and S&P Midcap 400 gave back most of Tuesday's gains, while the S&P 500 and Dow Jones have formed bull flag type patterns on the hourly chart, which suggests higher prices in the short-term.

Although many traders like to follow every single move in the major averages, tick by tick, we simply feel that it is unnecessary to do so (if swing to position trading) when the averages are in trend mode. Rather than getting caught up in calling a short-term top in the market, we prefer to focus on individual setups and executing the trading plan in every open position.

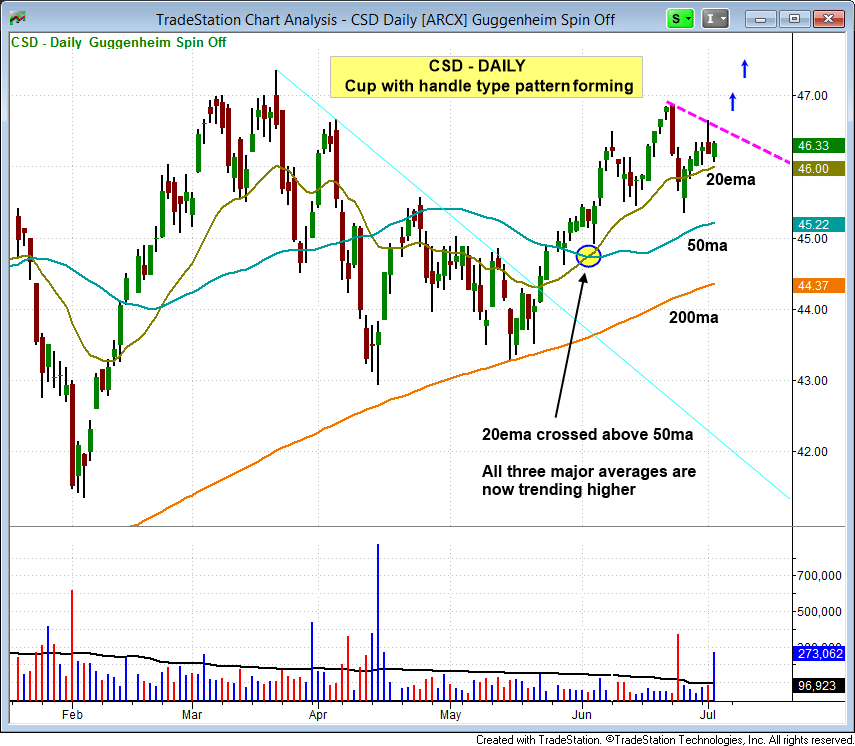

In today's Wagner Daily watchlist, we have two new ETF and three individual stock setups. Guggenheim Spin-Off ETF ($CSD) is one of the ETF setups, along with the recently discussed setup in iShares Philippines ($EPHE) (which has yet to trigger).

$CSD (click here for description) is currently forming the handle portion of a bullish cup and handle pattern. The cup portion starts on 3/21 and ends on 6/23, where the handle begins.

A breakout above the high of the handle on a pick up in volume is the obvious buy signal. However, we'd prefer to buy a little earlier than that if possible (as usual), so the recent pullback that held support at the 20-day EMA presents us with a low risk entry point.

The monthly chart of $CSD is sitting in a tight 8-month long range at all-time highs, while volume has tapered off the past few months. A breakout above the highs of the range should spark the next rally.

On the stock side we have one new setup in Lionbridge Technologies ($LIOX), which looks like it is ready to resume its uptrend after a 16-week base off the 40-week MA or 200-day MA.

$LIOX is back above the 10-week MA, which has flattened out and is beginning to turn up. If our buy entry over Wednesday's high does not trigger, then we'll look to enter on weakness around the 10-day MA.

Yesterday, we sold three stocks in our model portfolio to lock in solid gains: $BDSI +19% (partial size), $ANET +15%, and $TSLA +14%.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|