| The Wagner Daily ETF Report For July 2 |

| By Deron Wagner |

Published

07/2/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For July 2

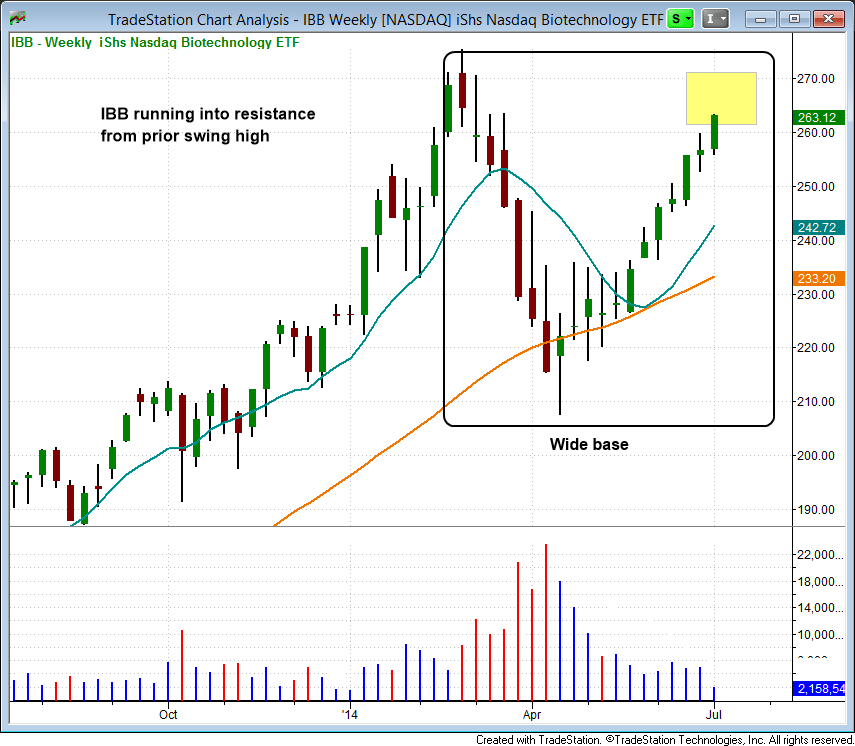

Stocks rallied across the board on higher volume yesterday, led by a +1.1% gain in the Nasdaq with help from strong moves in biotech ETF ($IBB) and semiconductor ETF ($SMH).

The S&P 500 rallied +0.7% higher, but underperformed the Dow Jones. As mentioned yesterday, the S&P could use some help from financial stocks. Financial ETF ($XLF) did attempt to breakout above the range high on Tuesday but failed. Banking ETF ($KBE) also broke out, but failed to close near the highs of the day. Let's see if $KBE can work its way higher over the next few days.

The Nasdaq is in good shape for now, but at some point the already extended semiconductor index will need to pull back in, along with Biotech ETF ($IBB) which is already near a key resistance level.

The rally in $IBB began at the lows of a wide base after a two-month long selloff on very heavy volume. $IBB has rallied for seven weeks straight on much lighter volume, with little consolidation along the way.

This is not the type of basing action that produces a powerful breakout to new highs, as the price action will eventually run out of steam from having to recover from such a sharp selloff.

We do not have a crystal ball, but $IBB should run out of steam in the $260 - $270 area, with the possibility of a quick false breakout to new highs.

Once the rally is over, if $IBB can consolidate for five to eight weeks in a fairly tight range above the 10-week moving average, then it could potentially set up for a legitimate breakout (a very late stage one).

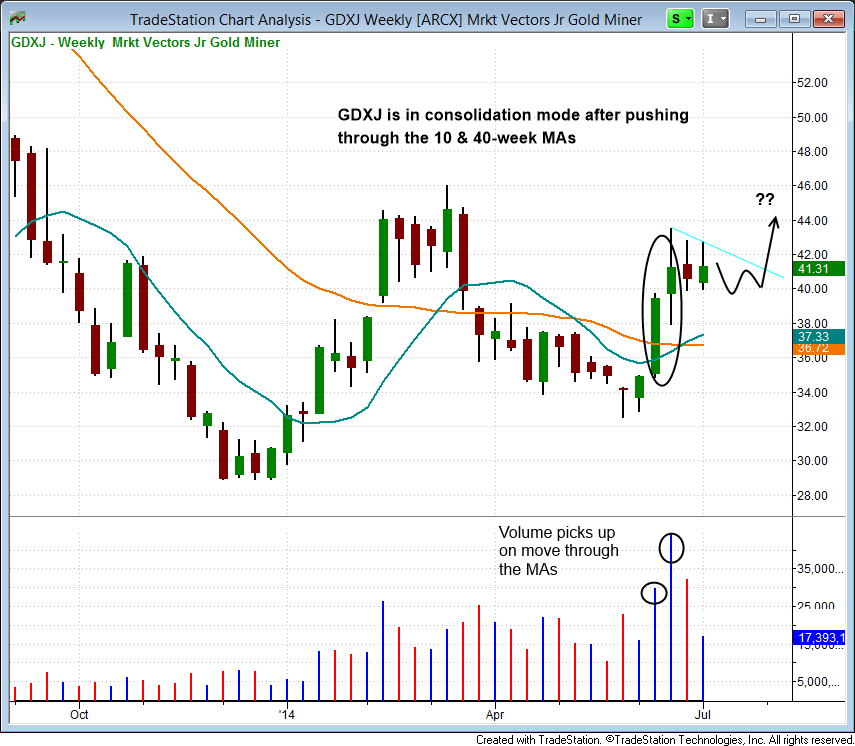

Junior Gold Miners ETF ($GDXJ) is in consolidation mode after an explosive price and volume move through the 10 and 40-week moving averages a few weeks ago.

After a 40% rally off the lows at $20, $GDXJ is potentially forming a 16-week cup with handle type pattern on the weekly chart.

The handle portion is the current tight consolidation. Ideally, the volume should taper off as the price action chops around for a few weeks. Note that the 10-week MA (teal) has crossed above the 40-week MA (orange), which is a bullish trend reversal signal.

There is no actionable, low-risk entry point in $GDXJ right now, but we will continue to monitor the action. As always, we will alert subscribers of The Wagner Daily if/when the trade setup meets our criteria for buy entry.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|