| The Wagner Daily ETF Report For June 4 |

| By Deron Wagner |

Published

06/4/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For June 4

Stocks continue to chop around in a pretty tight range, with the NASDAQ Composite basically unchanged over the past five sessions, waiting for the 10-day MA to catch up.

Although there has been some early morning selling the past few sessions, the major averages have closed each session near the highs of the day, suggesting buyers are stepping in.

We view the price action over the past 3-5 days in the averages as bullish in the very near-term, though the intermediate-term head and shoulders pattern on the NASDAQ remains a concern.

We have one new setup for potential buy entry on today's Wagner Daily watchlist, which is S&P Midcap 400 ETF ($MDY).

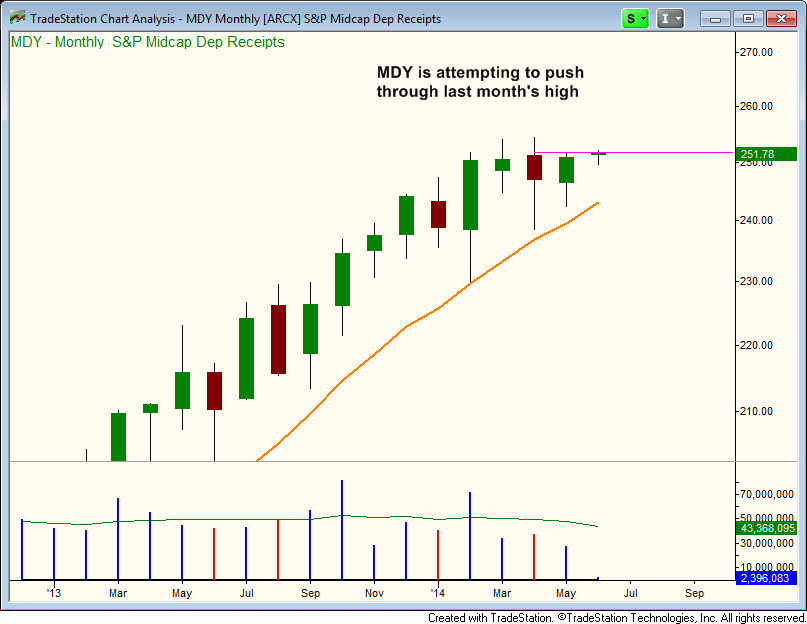

The monthly chart below shows $MDY trading in a fairly tight range the past three months, with the rising 10-month moving average providing support just below:

Drilling down to the weekly chart time frame, we see the price action climbing above the $250 resistance level and the downtrend line last week. The price action is holding above $250, with the 50-day MA beginning to turn up:

The daily chart shows the tight price action, with the past several sessions above the rising 10-day MA. Note that the 20-day EMA has crossed above the 50-day MA, and the 50-day MA is flattening out.

We look for $MDY to hold support at the rising 10-day MA and push to new highs:

When looking the monthly, weekly, and daily charts of $MDY, we have multiple time frame convergence that is a key factor in helping a trade lead to a profitable outcome.

Although we are using $MDY for our chart analysis, we instead plan to buy $MVV, a leveraged version of $MDY, in our nightly swing trading newsletter.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|