| The Wagner Daily ETF Report For April 24 |

| By Deron Wagner |

Published

04/24/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 24

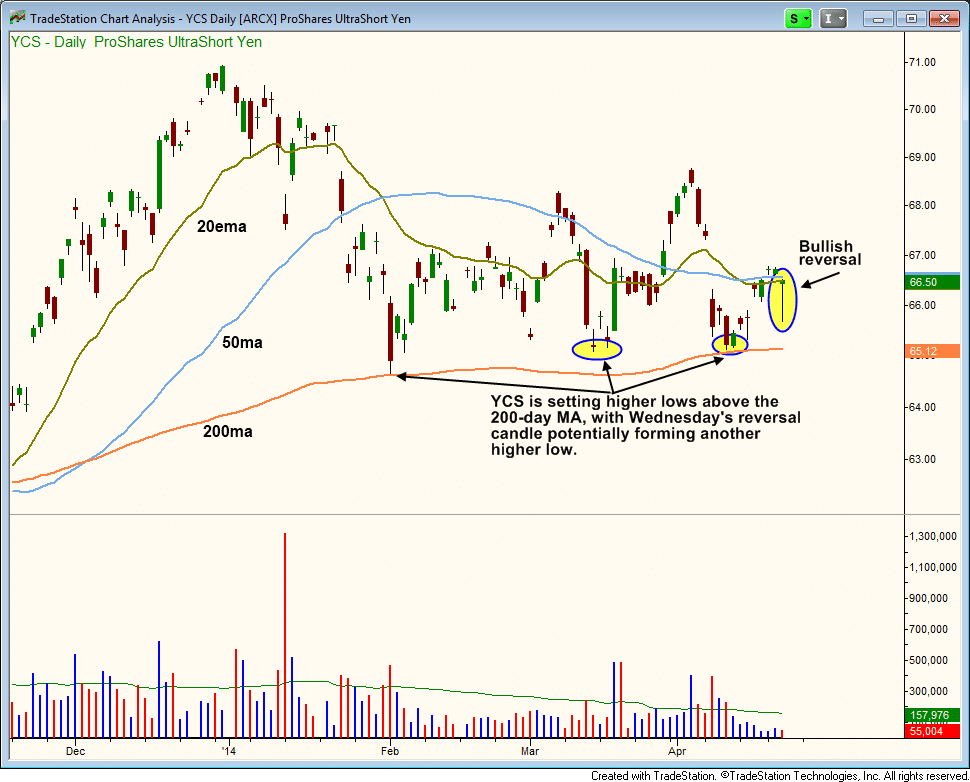

ProShares UltraShort Yen ($YCS), a currency ETF, has settled in a tight trading range the past few months after a 12% rally to close out 2013. The price action continues to hold above the 200-day MA, with higher swing lows within the current base:

$YCS held support at the 200-day MA two weeks ago, and formed a bullish reversal candle on Wednesday, which could potentially set another higher low.

The 20-day EMA is currently below the 50-day MA, but should return back above if $YCS can clear $67 and push higher.

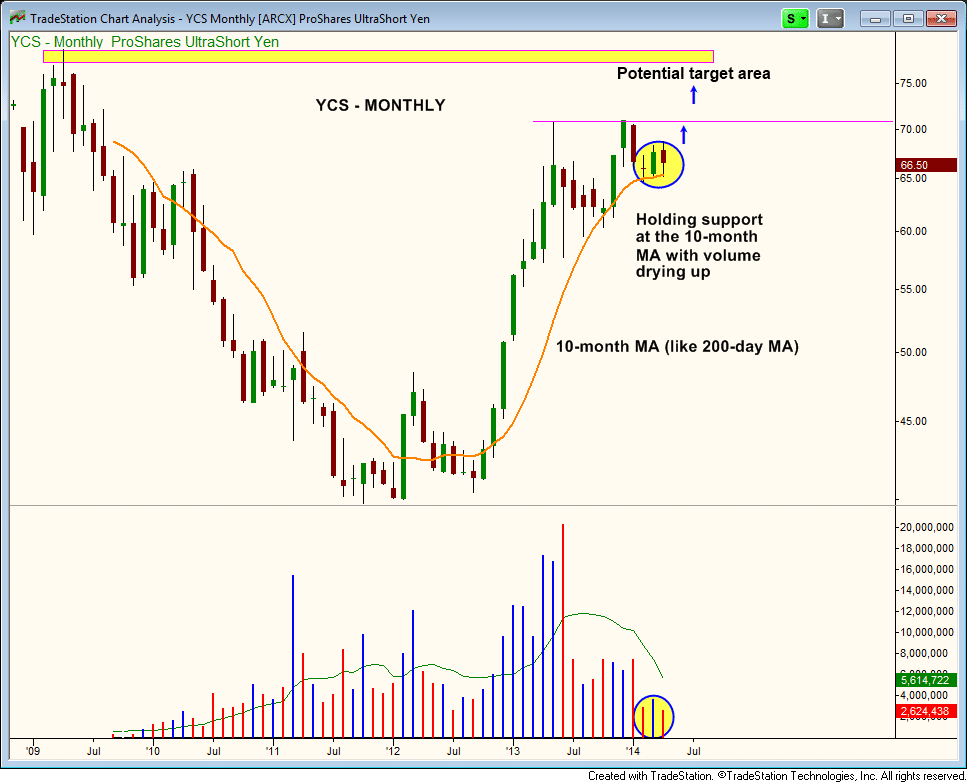

The longer-term monthly chart shows the potential target if the $YCS setup triggers. Note the tight action on the monthly chart the past three months, as the price action continues to hold the 10-month MA:

We are placing $YCS on today's Wagner Daily ETF watchlist with a buy stop order, based on Wednesday's bullish reversal action. Subscribing members should see today's report for all the swing trade details.

On the stock side, we continue to lay low. Our nightly scans failed to produce much in the way of high quality buy setups, and we still believe it's a bit too early to get busy on the short side. Though select shorts may work now, we would prefer to see the Nasdaq take out the 50-day MA to produce very low risk short setups.

Overall, we can afford to be patient with the short side as the market still has the potential to push higher (S&P 500 has the potential to be at new highs within a few days).

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|