| The Wagner Daily ETF Report For April 17 |

| By Deron Wagner |

Published

04/17/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 17

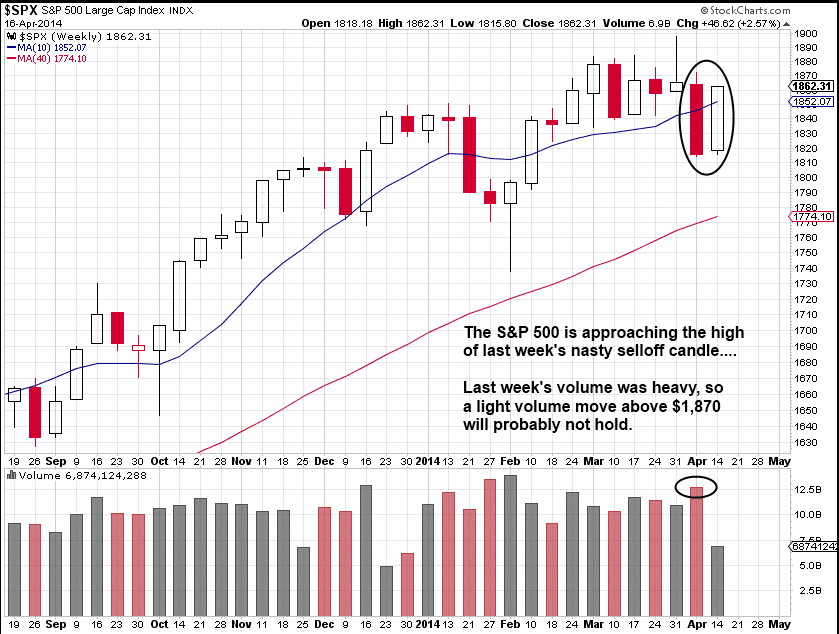

Yesterday's broad market advance put the S&P 500 near last week's high, and back above the 50-day MA and 20-day EMA, but the bounce was once again on declining volume. Considering how ugly the price and volume action was last week, this week's rally attempt seems quite weak.

There is always the possibility the S&P 500 could push to new highs, but given how ugly most charts are, we doubt such a move would hold for very long:

As far as resistance in the NASDAQ Composite, the downward sloping 20-day EMA is just above, but the prior swing high around 4,180 will be tough to overcome.

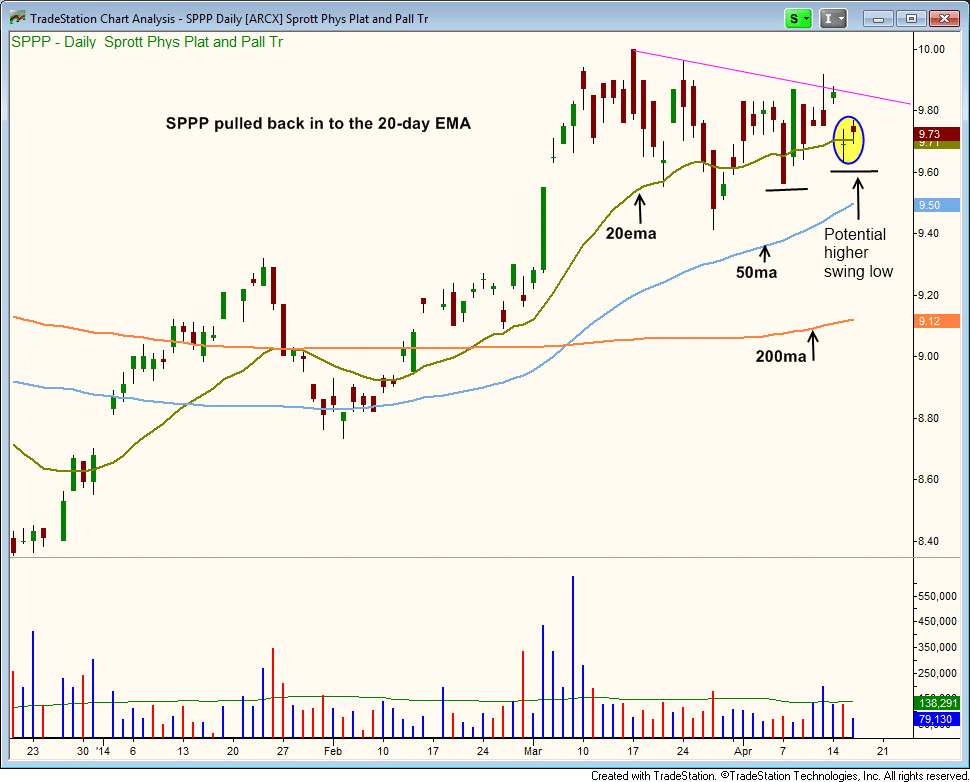

Earlier this week, we listed Sprott Physical Platinum & Palladium ($SPPP) as a potential breakout setup from a tight-ranged consolidation.

Now, $SPPP is pulling back to its 20-day EMA on light volume, presenting us with a low-risk entry point. Note the higher lows within the base, as the price action continues to tighten up from left to right. Trade details can be found in the watchlist section above.

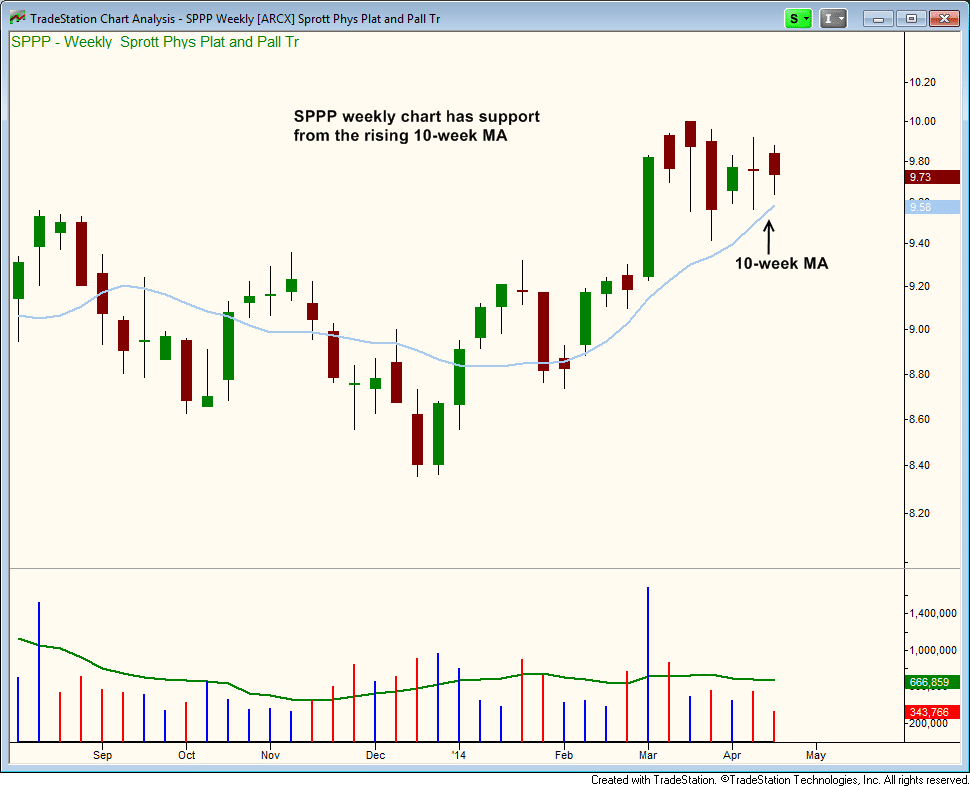

The weekly chart of $SPPP gives the setup a bit more support, as the rising 10-week MA is just below the 20-day EMA on the daily chart at $9.58:

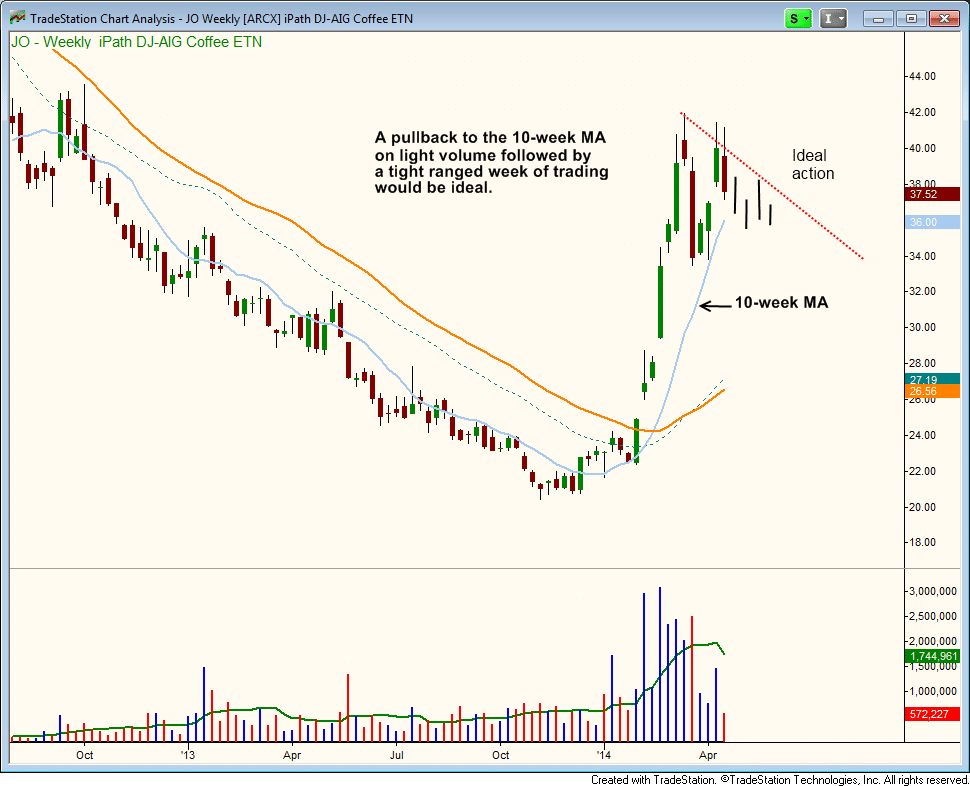

After a monster breakout above the 40-week MA earlier this year, the Coffee ETF ($JO) is in correction mode, with the 10-week MA recently catching up to the price action. The weekly candlesticks are still a bit too volatile and will need to settle down to produce a low-risk entry point.

On the weekly chart below, we filled in a few bars of price action to give an idea of what we are looking for. The price action certainly doesn't have to play out this way, and we are flexible enough to go with the flow when we have to:

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|