| The Wagner Daily ETF Report For April 15 |

| By Deron Wagner |

Published

04/15/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 15

Stocks reversed well off the lows of the session during the final hour of trading, potentially setting higher swing lows or double bottom type lows on the hourly charts of most major averages.

The reversal action on the hourly charts suggests that the market could push higher for several days to work off the short-term oversold conditions.

Turnover was lighter on both exchanges, and may be so the rest of this holiday shortened week (US markets will be closed this Friday, April 18).

With most equity based ETFs recovering from an ugly selloff, commodity-based ETFs continue to see solid price and volume action.

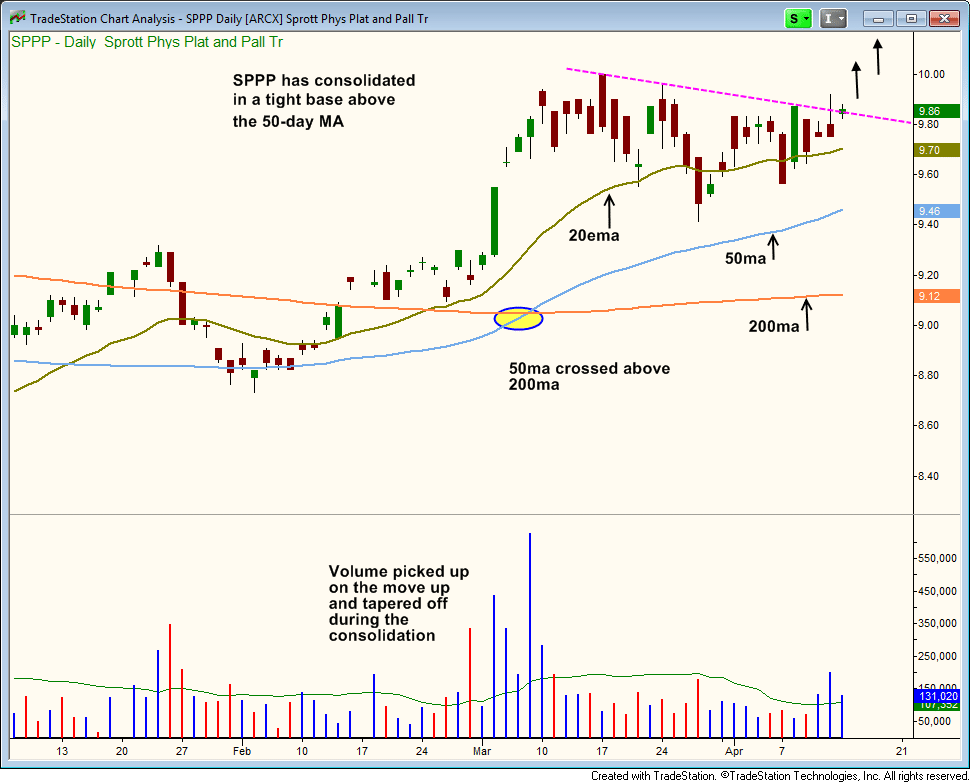

Sprott Physical Platinum & Palladium ETF ($SPPP) has been in consolidation mode for several weeks after clearing resistance at $9.30 on higher volume in early March.

Volume picked up during the breakout but has tapered off the past few weeks before the last three sessions, which is a bullish sign. There are no signs of heavy volume selling in the base, which is also bullish.

The 50-day MA crossed above the 20--day MA back in March, and all three major moving averages are now in a clear uptrend

We are placing $SPPP on today's ETF watchlist, as we expect the uptrend to resume once the short-term consolidation gives way to a range breakout on higher volume (see watchlist above for trade details).

With so many industry groups breaking major support levels on higher volume the past few weeks, we will need some sort of bounce in these charts in order to identify low risk entry points on the short side.

One ETF that we are monitoring for a potential short entry down the road is PowerShares Dynamic Media Portfolio ($PBS), which recently cracked the 10 and 40-week MAs on big volume.

A bounce above the 40-week MA would be ideal, with the price action forming reversal candles in the area between the 38.2% and 50% Fibo levels (around $24.70 to $25).

The Fibonacci levels are calculated using the recent swing high to the recent swing low (both levels are near the gray anchor lines).

Rogers International Commodity Index ETF ($RJI) broke out above range highs on decent volume yesterday and is still buyable for those who missed our original entry.

On the stock side, we remain long $TSLA and $INVN, and have one new pullback setup on today's watchlist in $CPE. Regular subscribers of The Wagner Daily should note our exact trigger, stop, and target prices in the "Watchlist" section of today's report.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|