| The Wagner Daily ETF Report For April 11 |

| By Deron Wagner |

Published

04/11/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 11

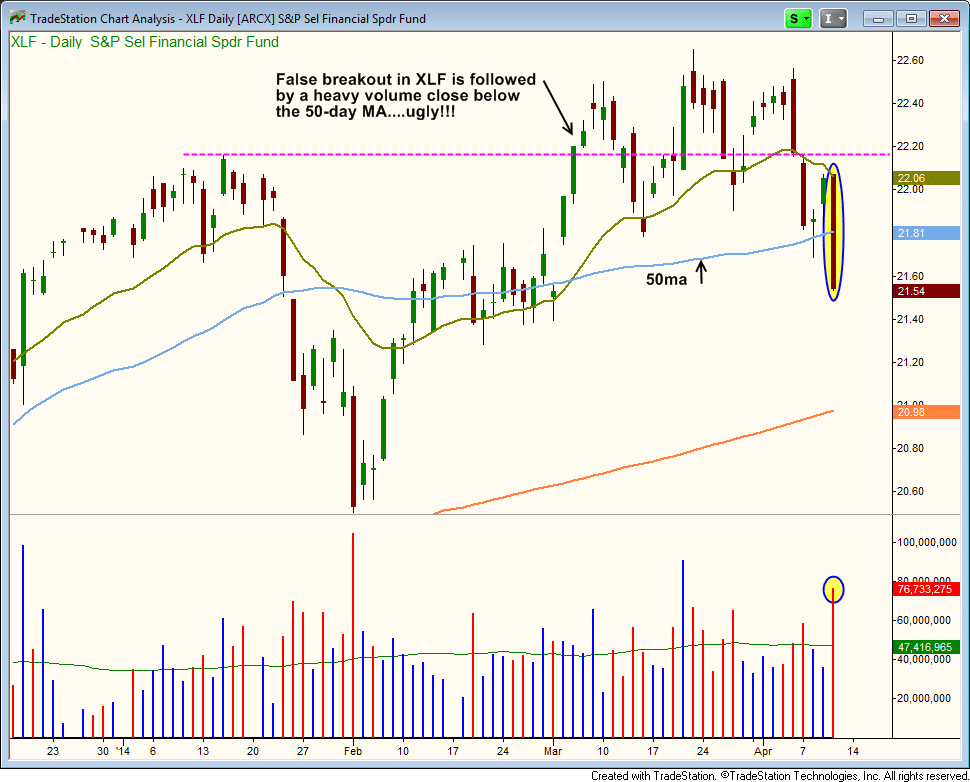

Yesterday's meltdown, in which the NASDAQ Composite plunged more than 3%, produced ugly price and volume action in two leading ETFs, Financials ($XLF) and Transportation ($IYT).

Although the Transportation ETF ($IYT) is still above the 50-day MA, Thursday's selloff was on huge volume. After a false breakout to new highs, this is definitely not the type of price action one wants to see.

Similarly, the Financial ETF ($XLF) also formed a false breakout at new highs, but followed up that move with a nasty breakdown below the 50-day moving average on heavy volume yesterday:

In the April 7 issue of The Wagner Daily (and in this blog post), I said, "The recent resurgence in energy-related stocks has been helping the S&P outperform the NASDAQ lately, but if financial and transportation stocks begin breaking below their 50-day moving averages, the S&P 500 may soon fall apart and join the NASDAQ."

Based on yesterday's price action, the above scenario points to the S&P falling to "catch up" to the NASDAQ, which is already broken down, in the coming days/weeks.

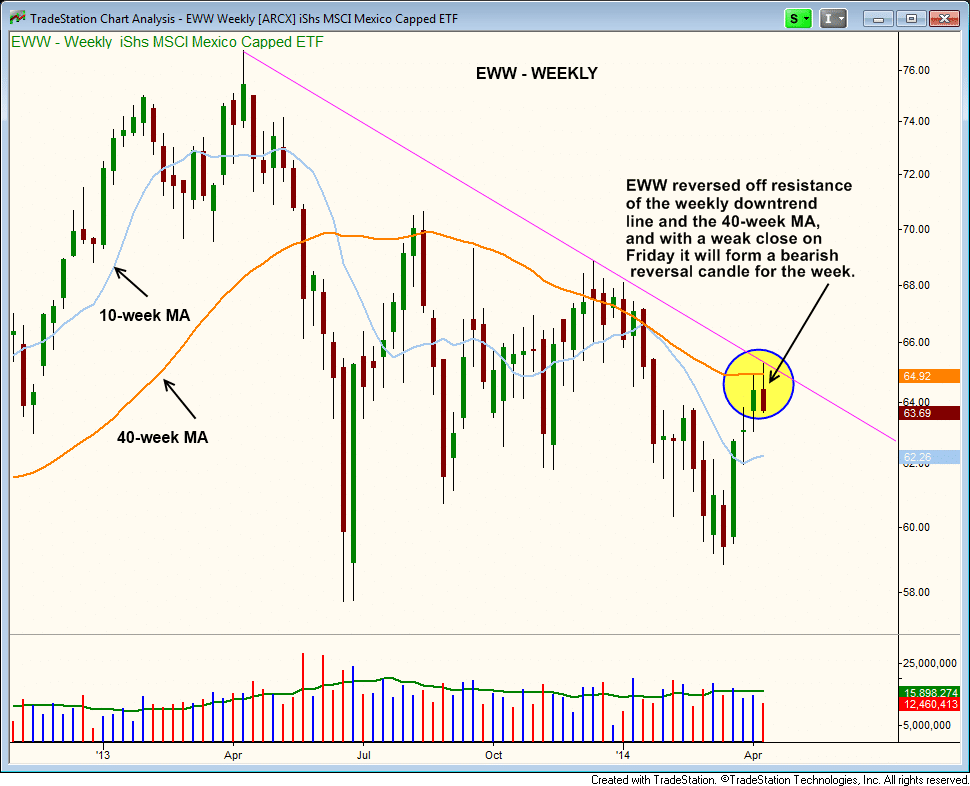

After scanning for potential short setups, we came across an actionable short setup in iShares Mexico ETF ($EWW).

The weekly chart below shows the month-long, countertrend bounce off the lows in $EWW. The price action has stalled at the 40-week MA over the past two weeks, and reversed off the weekly downtrend line this week.

Although $EWW moved above its 50-day moving average on the bounce, it did so without setting a meaningful swing low. As such, there is less chance of the price action finding support on a pullback.

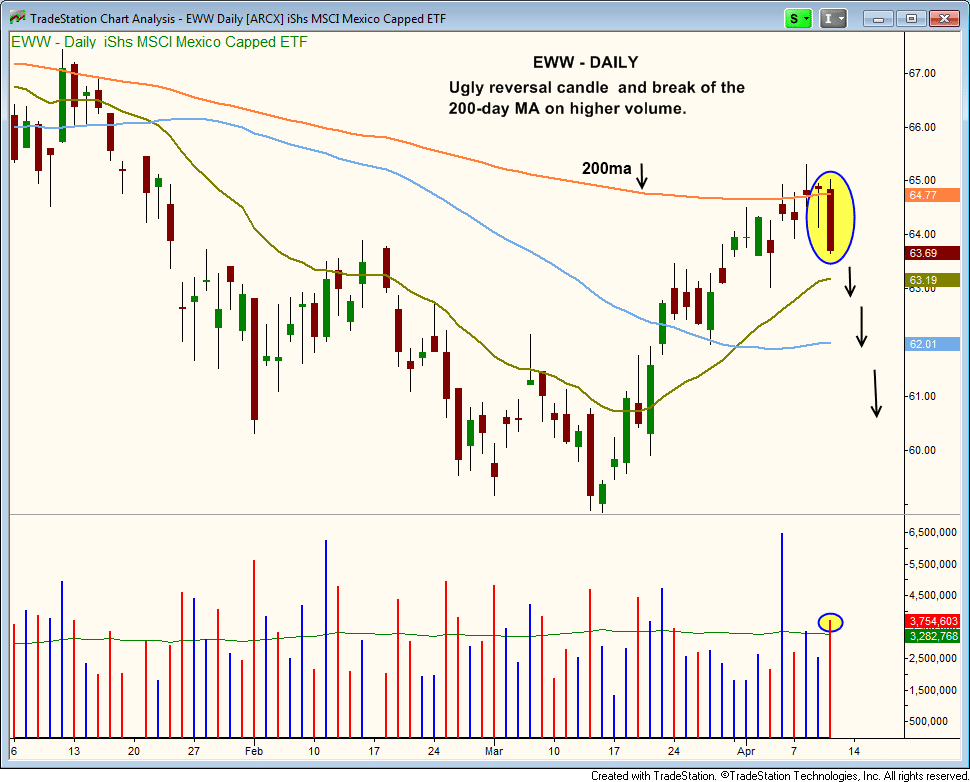

Yesterday's selloff also produced a rather bearish reversal candlestick on higher volume, after four days of stalling action at the 200-day moving average:

Since the entry is off the 200-day moving average, the trade make take a bit more time to play out to the downside (due to support of the 50-day MA below).

Because there is no inverse (short ETF) alternative to $EWW, we are not listing the trade as an "official" swing trade setup in today's report (to be fair to those with qualified/non-marginable trading accounts). However, subscribers interested in taking the trade should see our detailed comments for entry and exit prices in the "notes" section.

Another short setup we're stalking for potential entry today is Daily Gold Miners Bear 3x ($DUST), a leveraged "short ETF" that inversely tracks the price of a basket of gold mining stocks. Check it out:

$DUST ripped higher off the lows, on a pick up in volume, before stalling out just above its 50-day MA. The two-week pullback has been on lighter volume, with the exception of the past two days where volume has picked up, but the price has not gone lower (this is bullish).

Our preset and exact entry, stop, and target prices for the $DUST swing trade setup can be found in the "ETF Watchlist" section of today's newsletter.

On the stock side, there is no reason to establish long entries right now or for the next few weeks. If/when the NASDAQ bounces, it should finally provide us with low-risk short entries because the NASDAQ is in trouble.

A few stocks we are monitoring on the short side are (these stocks are NOT actionable right now): $DDD $ULTA $CTRX $NFLX $BIDU $LULU $AMZN $AAPL $CI $RAX $RL $BBBY $COH. Obviously, we are not limited to these stocks for short setups because new patterns will likely develop within the next few weeks. Still, just a heads-up for a few potential short candidates to put on your watchlist for the coming days/weeks.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|