| The Wagner Daily ETF Report For April 4 |

| By Deron Wagner |

Published

04/4/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 4

Commodity-based ETFs remain in good shape as they continue to digest recent explosive action. $UNG, $CORN, $URA, $LIT, $JO, and $WEAT are a few we own or are currently monitoring for new low risk entry points.

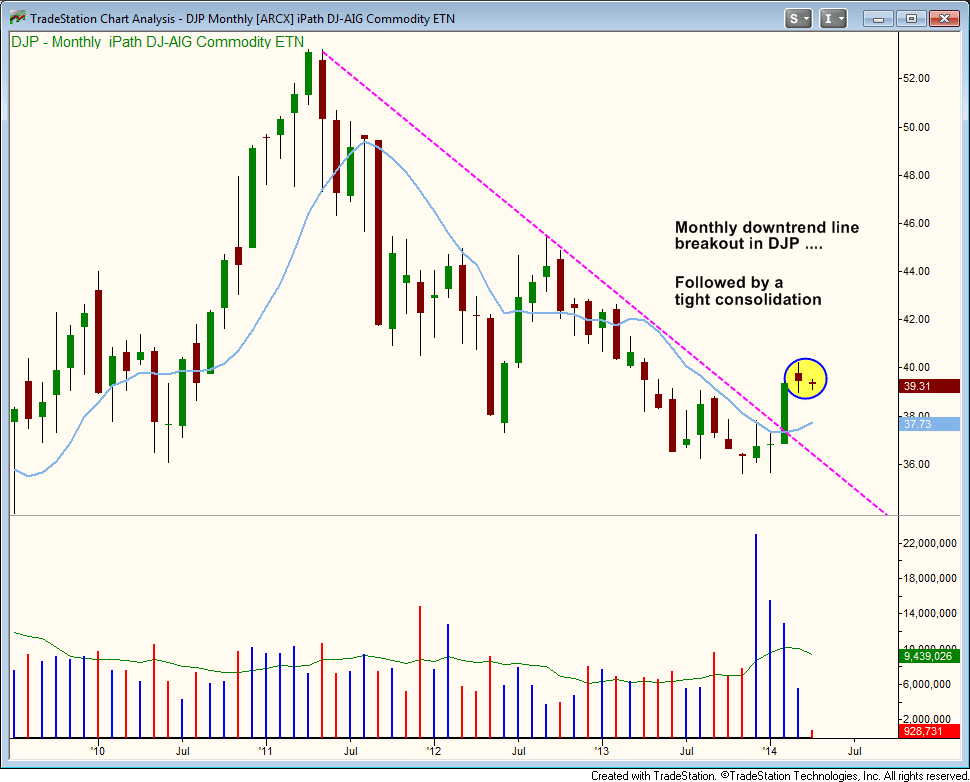

iPath Dow Jones UBS Commodity Index ($DJP), which tracks the performance of energy, agriculture, livestock, and industrial and precious metals, is looking good after breaking a monthly downtrend line in February on higher than average volume. Since then it has been consolidating in a tight range.

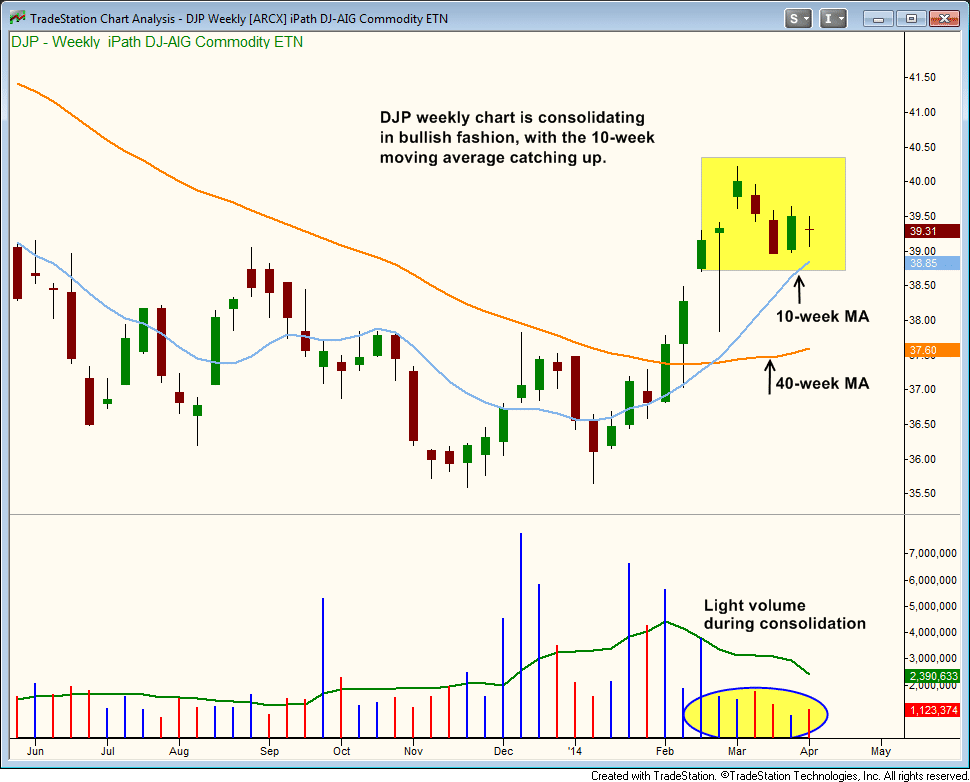

On the weekly chart, the 10-week MA has crossed above the 40-week MA, which is is bullish trend reversal signal. The 40-week MA, like the 10-week MA is now trending higher as well.

The volume pattern is quite bullish, with volume picking up on the breakout above the 40-week MA and drying up during the consolidation.

$DJP is currently in week four of its base, and should eventually touch the 10-week MA. How the price action acts around the 10-week MA should tell us what to do in terms of an entry point.

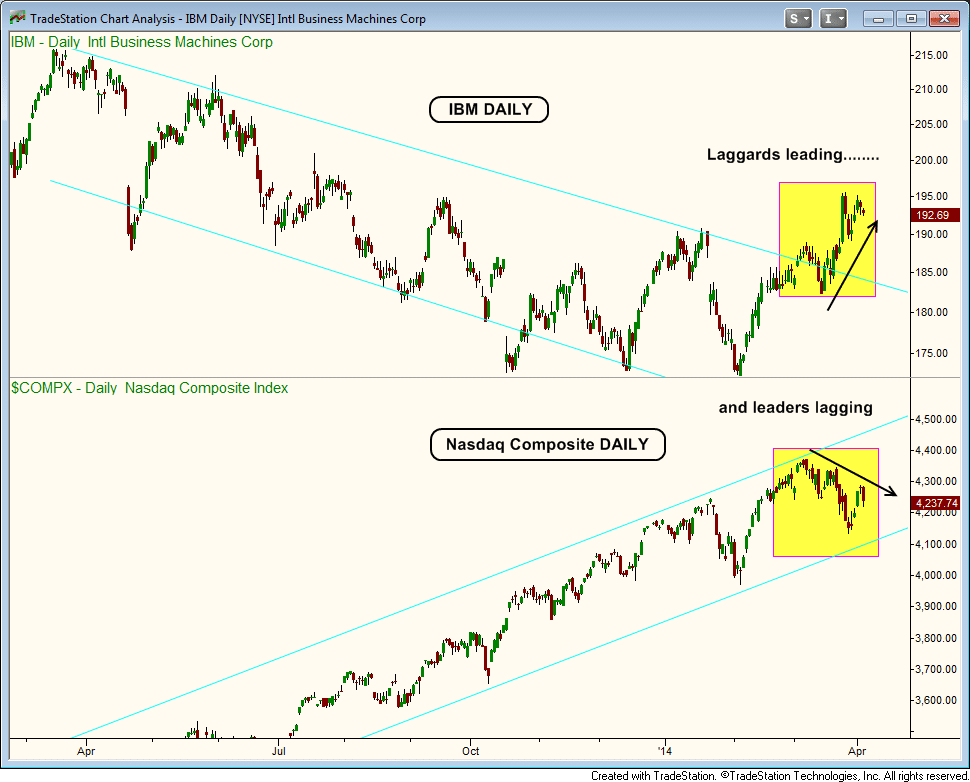

Money has rotated out of extended tech names and into slower trading big cap stocks. This is not a healthy sign as it suggests that insitutions are moving away from risk and into safety in anticipation of a market selloff (whenever that may be).

The Nasdaq Composite had quite a run in 2013 and a nice pop in February. During that time, $IBM was in a strong downtrend, which it finally cleared in February. Since the Nasdaq topped out a few weeks ago, $IBM has cleared prior swing highs and is pushing higher. Laggards ($IBM) are leading and leaders (Nasdaq) are lagging:

Although the Nasdaq Composite avoided a distribution day due to the light volume, the poor price and volume action in the leading names is a concern. Hopefully, the Nasdaq can hold on to the prior swing low while leading stocks stabilize.

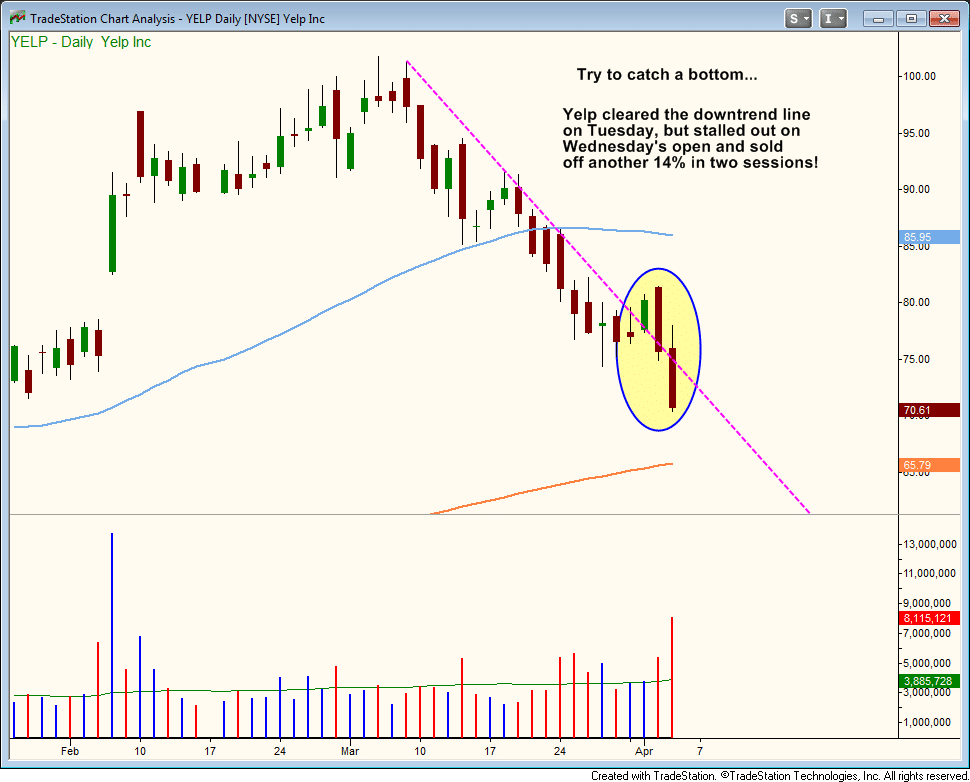

Thursday's action in $YELP is why we try to avoid catching a bottom in a stock that has taken a beating below the 50-day MA. $YELP stuck its head out above the downtrend line for one day before reversing 14% lower in just two days.

We don't mind trying to catch a bottom in a stock when it is a market leader pulling into the 50-day MA. But when a stock blows through the 50-day MA on big volume, it is best to leave it alone for a while until it finds some traction (maybe a higher low over one or two weeks).

If you are just now subcribing to the newsletter, patience is key as the market is simply not the same as it was a few months ago. Timing is everything in the market, and the reward to risk ratios on the stock side are simply not good right now. There seems to be a little too much aggravation for very little to no reward! It is best to lay low right now and wait for better setups to emerge.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|