| The Wagner Daily ETF Report For April 3 |

| By Deron Wagner |

Published

04/3/2014

|

Stocks

|

Unrated

|

|

|

|

The Wagner Daily ETF Report For April 3

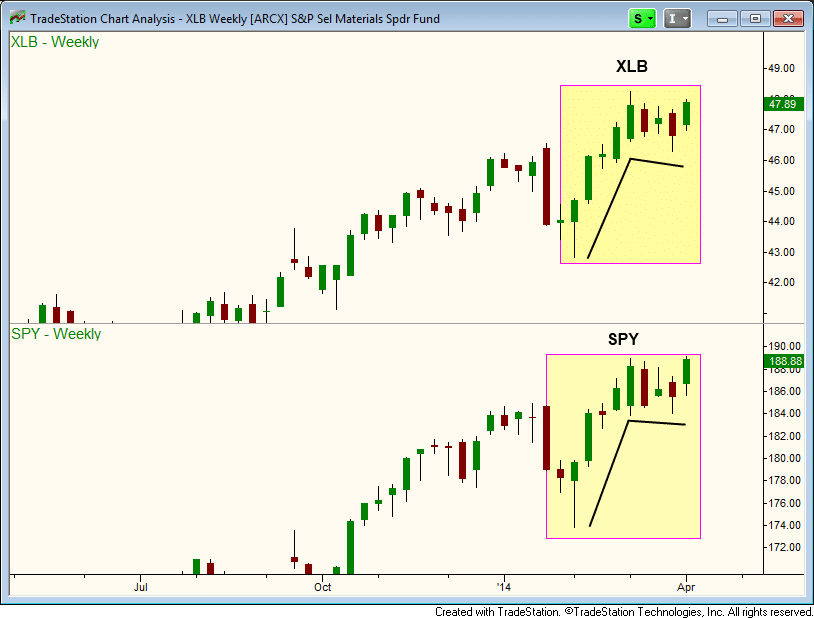

The weekly chart of SPDRs Select Materials ETF ($XLB) is showing a bull-flag type pattern since running up off the lows of February, looking much like the weekly chart of $SPY.

The flag pole portion of the pattern was five weeks in length. If the pattern is to show proper symmetry, then the flag portion of the pattern should take four to six weeks to form before the uptrend resumes. $XLB is currently on week four of consolidation, so it should move out within the next week or two:

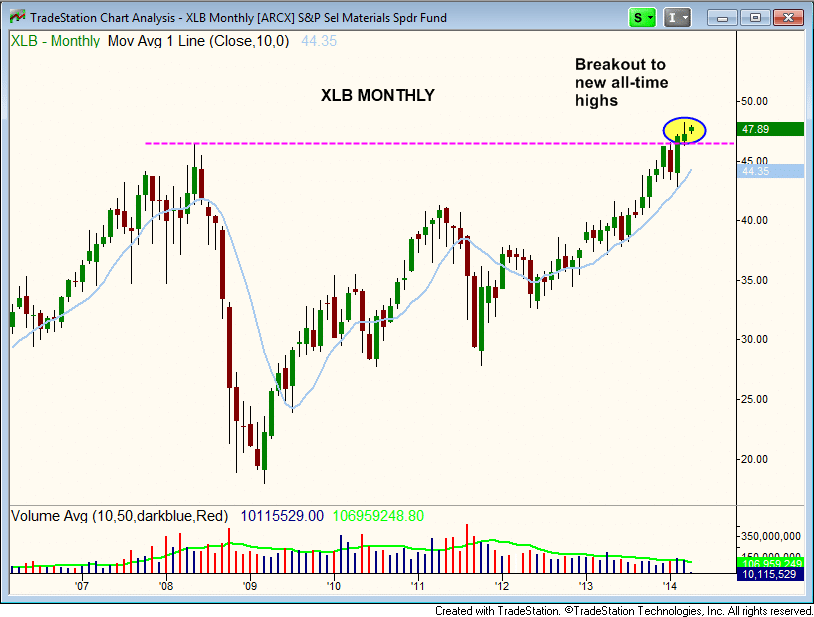

A breakout above the high of the current range would also represent follow-through on the recent breakout to new all-time highs over the past two months. Both candles cleared the prior highs of 2008, but failed to follow through. This is shown on the long-term monthly chart of $XLB below:

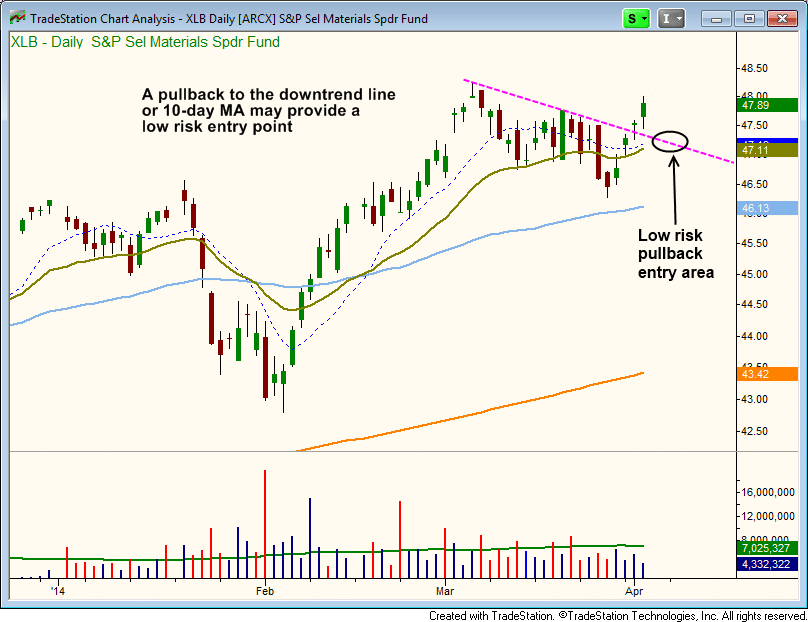

Dropping down to the shorter-term daily chart (below), we see that $XLB has been consolidating in a fairly tight range, with just one shakeout below the 20-day EMA. The lows of the current consolidation has retraced less than 38% of the last wave up (nearly a 13% rally off the lows, with only a 4% pullback off the highs):

A very simple guideline for measuring the strength of a move is to note the depth of the correction during the first pullback. A 4-5 point pullback would be a normal reaction to a 10-point advance, and indicate that the trend should continue after a short-term pause. However, a 7-point pullback would be a bit too deep, and would reduce the odds of further upside in the short-term.

XLB's reaction to the last move up has been quite bullish, and suggests there should soon be another wave up.

Ideally, we would like to see $XLB pull back into the downtrend line for a low-risk entry point. However, we are prepared to buy on strength if we have to. As always, subscribing members of The Wagner Daily will be alerted to our exact entry, stop, and target prices for $XLB if the setup meets our criteria for low-risk entry point.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.

|