| How to Use Symmetrical Triangles |

| By Andy Swan |

Published

05/1/2007

|

Currency , Futures , Options , Stocks

|

Unrated

|

|

|

|

How to Use Symmetrical Triangles

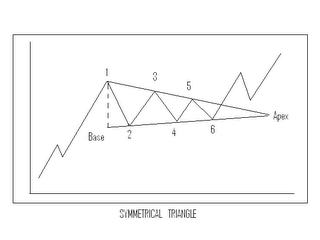

The symmetrical triangle, or coil as it is sometimes known, is usually a continuation pattern which represents a pause in an existing trend. After the symmetrical triangle, the trend resumes its original direction. The graph below shows the trend prior to the triangle is up, so it is assumed that the trend will remain an uptrend after the symmetrical triangle.

A triangle requires a minimum of four reversal points because each trendline requires 2 points. Looking at the above graph, the triangle begins at point 1 which is where the consolidation begins in the uptrend. Prices pull back to point 2 and rally to point 3, which is lower than point 1. Once the prices decline from point 3, the upper trendline can be drawn.

Point 4 is higher than point 2. The lower upslanting trendline cannot be drawn until prices rally from point 4. Only when the four reversal points have been established can our trader deduce he or she is dealing with a symmetrical triangle.

Although the minimum is four reversal points, it's not unusual to see six. These six points create 5 waves within the triangle before the uptrend resumes.

Andy Swan is co-founder and head trader for DaytradeTeam.com. To get all of Andy's day trading, swing trading, and options trading alerts in real time, subscribe to a one-week, all-inclusive trial membership to DaytradeTeam by clicking here.

|