After a nasty morning sell-off, stocks bounced sharply off the morning lows in the afternoon, lifting most broad market averages into positive territory by the close.

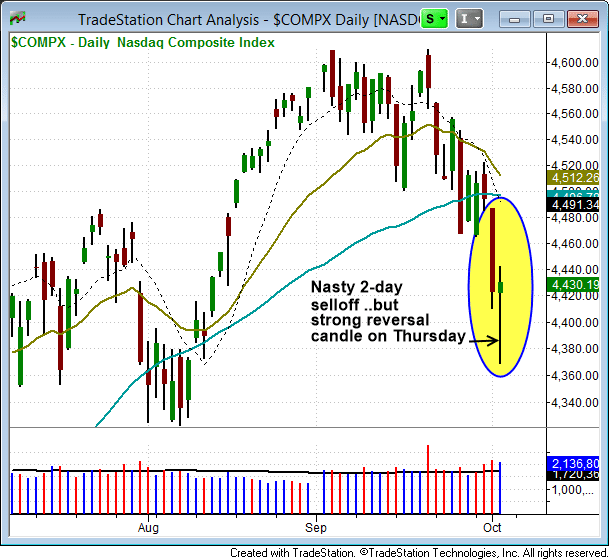

After a nasty morning sell-off, stocks bounced sharply off the morning lows in the afternoon, lifting most broad market averages into positive territory by the close. The reversal action was bullish (see daily chart of Nasdaq below), and suggests more upside in the short-term. That being said, the market has yet to stabilize, so we are in no rush to add a ton of long exposure this week.

Wild ride in the Nasdaq the past two days!

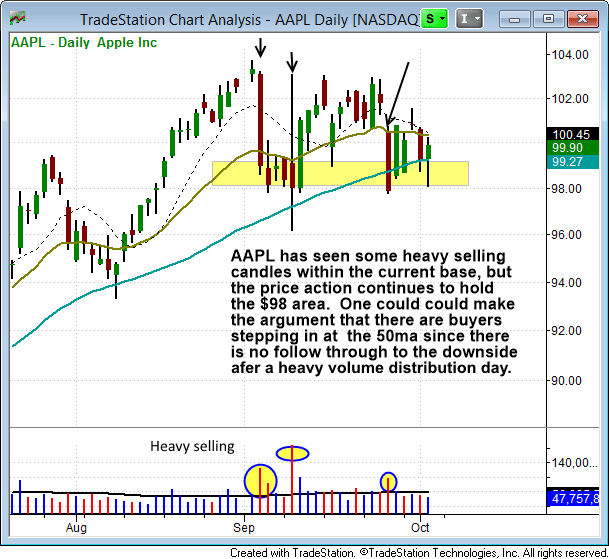

As mentioned yesterday, the price action in leading stocks is preventing the timing model from shifting into sell mode. Some leading stocks have broken down and that is to be expected when the market sells off sharply, but many charts are still very much intact.

Looking at a chart of Apple ($AAPL), we see mixed signals in the basing action, as there has been several days of heavy volume selling, with the highest spikes in volume during the base coming on down days. However, there must be buyers present around the $98 level to prevent the stock from breaking down, as every major down day has failed to lead to a new swing low. Until there is a clear break of the 50-day MA and the base lows, $AAPL still has a shot to move higher.

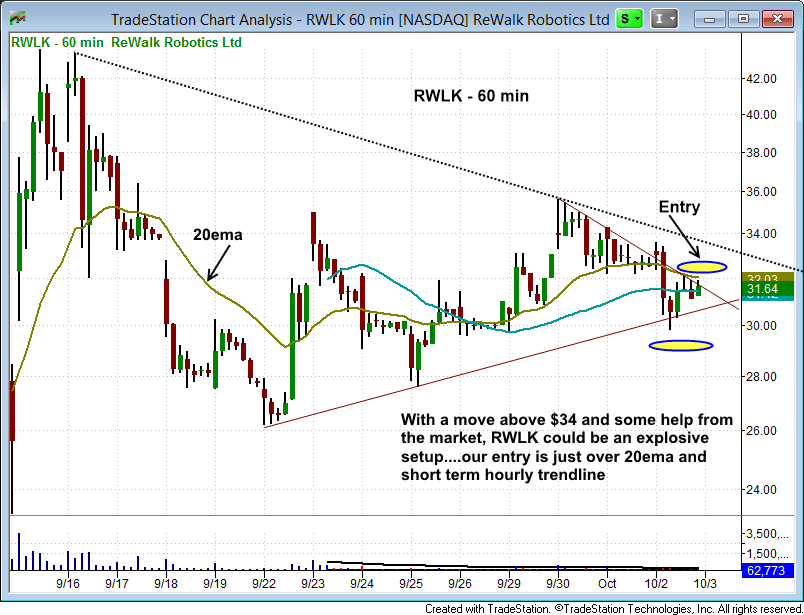

Based on Thursday's reversal in the market, we are taking a shot on the long side in a potentially explosive IPO in the medical products industry, Rewalk Robotics ($RWLK).

We like tight range over the past two weeks, with the price action pulling back on lighter volume to the 10-day MA on a daily chart.

Pictured below is the hourly chart, where we are looking to enter over a short term hourly downtrend line. A move above $34 on volume could spark some action. Our stop is fairly tight, as this is pretty much a Go Or No Go (G.O.N.G.) setup (traders love acronyms).

At $30 and an average trading volume of at least one million shares per day, $RWLK has decent liquidity.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.