After a weak open, stocks bounced higher in the afternoon before selling off slightly into the close. All broad market averages closed in negative territory, but most losses were limited.

After a weak open, stocks bounced higher in the afternoon before selling off slightly into the close. All broad market averages closed in negative territory, but most losses were limited to -0.3% or less.

Total volume was lighter on both exchanges, so there was no distribution on the S&P 500 or Nasdaq Composite.

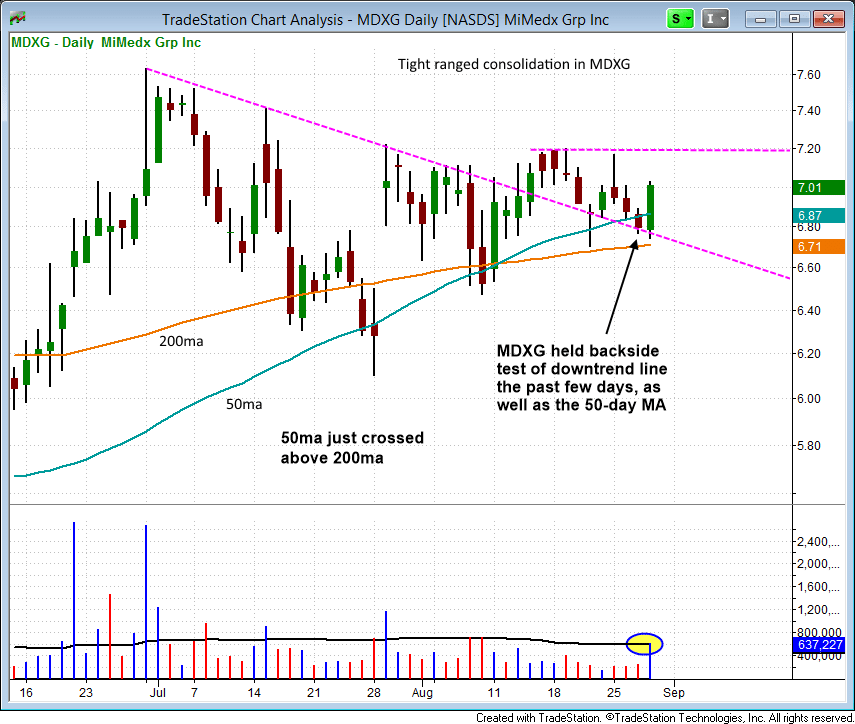

We have one new setup on today's watchlist in MiMedx ($MDXG), which has formed a tight-ranged consolidation above the 50 and 200-day MAs the past two months.

The 50-day MA recently crossed above the 200-day MA, putting all averages in proper order (20 > 50 > 200).

Volume has dried the past two months which is bullish. To see the dry up in volume one can place a 20-day EMA on the volume. On the move off the lows in June, the 20-day EMA of volume peaked at over 900,000 shares per day. As of this week, the 20-day EMA of volume is just below 400,000 shares per day.

The price action on the last 3 bar pullback held support of the 50-day MA and the backside of the downtrend line. Thursday's advance reclaimed the 50-day MA on a nice pick up in volume.

We are placing $MDXG on today's watchlist with two potential entry points:

-- entry A on strength - buy stop

-- entry B on weakness - buy limit order

Whichever entry triggers first is the one we will take. The other is to be canceled. Subscribers of The Wagner Daily should note our exact buy trigger, stop, and target prices in the "Watchlist" section of today's report.

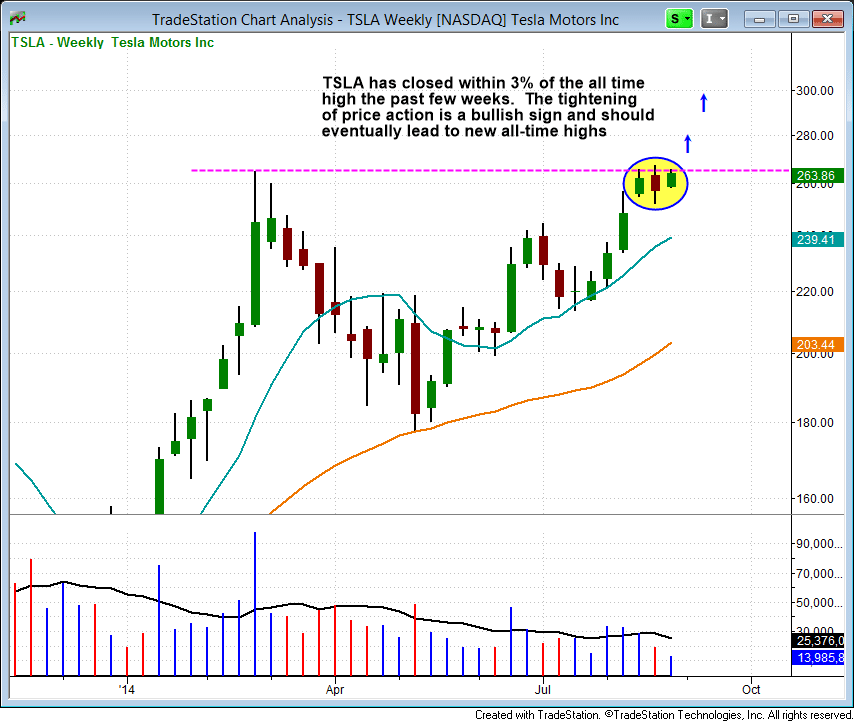

Our current long position in Tesla Motors ($TSLA) is in pretty good shape, as it consolidates in a tight range just below all-time highs on declining volume (thus far).

With the price action tightening up, it is only a mater of time before $TSLA runs to new highs.

Just a reminder that the US market will be closed on Monday, September 1. As such, there will be no report on Monday, but normal publication will resume on Tuesday.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.