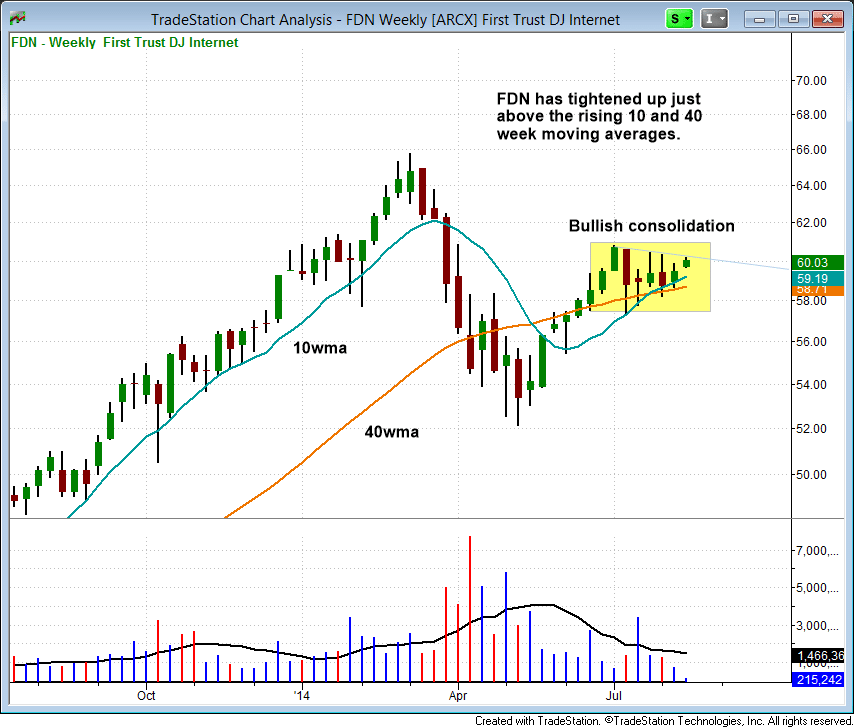

The Dow Jones Internet Index (FDN) was hit hard earlier this year, but has since rallied about 16 percent off the lows and formed a tight-ranged consolidation above the rising 10 and 40-week moving averages.

After a day and a half rally off the lows, the broad market averages sold off in the afternoon and closed well off the highs of the day. The averages are extended on the hourly chart and may need to consolidate a bit more to allow the 20-period EMA on the 60-minute chart to catch up.

The Nasdaq Composite reclaimed the 50-day MA, but volume was light.

The Russell 2000 bounced into the 20-day EMA and 200-day MA, so it may need a few days of sideways action before it can clear 1,150.

The S&P 500 is about 0.5% away from the declining 20-day EMA, and about 1% away from significant resistance in the 1,955 to 1,965 area, where the lows of a prior range and the 50-day MA converge.

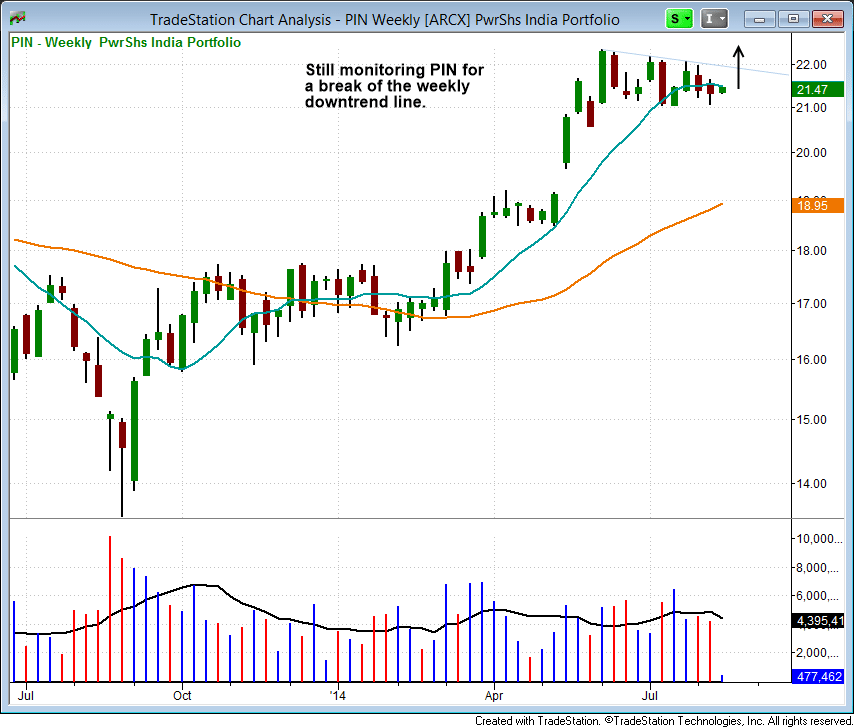

As far as potential ETF trade setups for The Wagner Daily model portfolio, we are monitoring a few breakout setups in $PIN and $FDN:

Although we sold out of Powershares India ($PIN) last week, we still like the price action, as it has held up quite well. We wouldn't mind a little shakeout below $21, which could spark a rally that breaks the short-term downtrend line:

The Dow Jones Internet Index ($FDN) was hit hard earlier this year, but has since rallied about 16% off the lows and formed a tight-ranged consolidation above the rising 10 and 40-week MAs. The 10-week MA also recently crossed above the 40-week MA, which is a bullish sign:

The pattern in $FDN is setting up nicely and could be ready to launch higher within the next week or two. Since $FDN took such a hit off the highs, we would not look for much more than a move to the prior highs ($64ish) as a target.

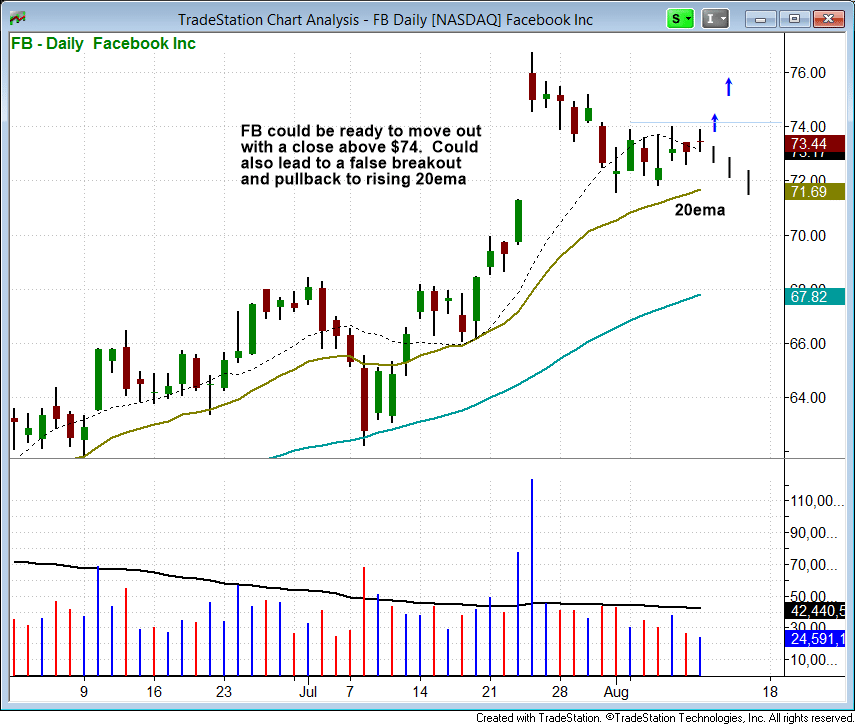

On the individual stock side, Facebook ($FB) is back on our watchlist, as we are monitoring the action for a breakout above the current range high:

If the $FB breakout can hold, then a test of the prior high is likely. However, if the price action pops above $74 and fails, then $FB could easily pull back in and run some stops below the 20-day EMA. Subscribing members of our swing trading report should note our exact trade details in the "Watchlist" section of today's issue.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.