The iShares Small-Cap Russell 2000 ETF (IWM) printed a decent bullish reversal candle on August 4, but has not yet followed through to the upside.

In yesterday's blog post, I said that our market timing model has just shifted from "buy" to "neutral," due to continued institutional selling and weakening of the major indices.

This means we are laying low with regard to new swing and core trade entries.

Nevertheless, we have spotted two very short-term momentum trade setups (one ETF and one individual stock) that could be in play over the next few days, each of which provides a relatively low-risk buy entry point.

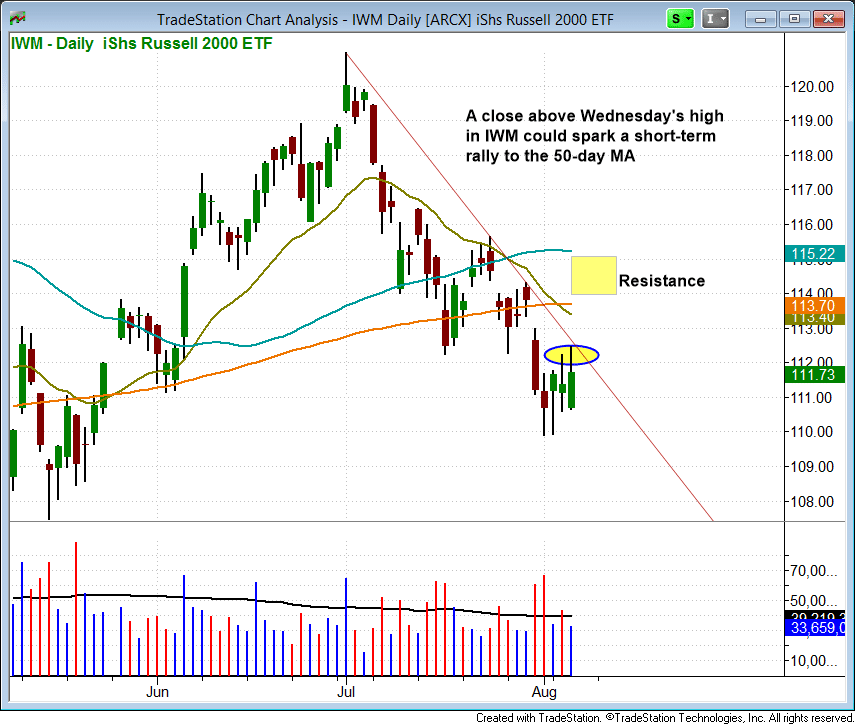

Russell 2000 ETF ($IWM)

The iShares Small-Cap Russell 2000 ETF ($IWM) printed a decent bullish reversal candle on August 4, but has not yet followed through to the upside (each of the past two sessions stalled above the prior day's highs).

However, a close above Wednesday's high, which converges with the downtrend line from the July 1 high, could still spark a short-term pop up to the $114 - $115 area.

This potential momentum trade setup is shown on the daily chart of iShares Russell 200 ETF ($IWM):

A potential buy entry point in $IWM is above yesterday's high and above the downtrend line (around $112.75).

Consider a protective stop about 1 - 1.25 points below that level.

Since there is major resistance of the 50-day moving average just above $115, don't expect to stay in this trade more than a few days (if it triggers for entry)/

With a potential reward of just over 2 points, combined with 1 point of risk, this setup still provides you with a decent reward-risk ratio of better than 2:1 (just over 2 points reward with 1 point risk).

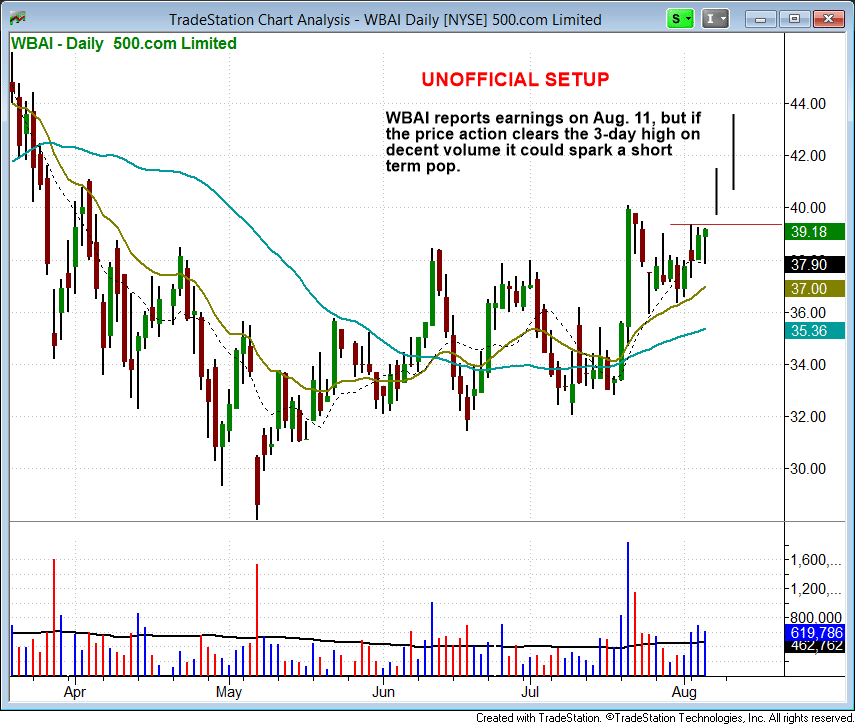

500.com ($WBAI)

Another possible momentum setup going into today is in Chinese Internet stock 500.com ($WBAI).

This trade setup looks pretty good for a quick 2-5 day trade ahead of its quarterly earnings report, which is scheduled for August 11.

As shown on the daily chart below, the buy entry is above the tight price action of the three-day high of $39.37 (solid volume should accompany such a move), with a protective stop just below Wednesday's low ($37.50 area).

The stop price needs to be tight because of the limited number of days ahead of its earnings report:

Overall, Chinese stocks and ETFs have been holding up well, but these stocks will eventually fold if the US market continues to struggle because most chinese ETFs are still range bound on their monthly charts, and have been for quite some time.

"GONG" Setups

Given recent market conditions, it's important to understand that both trade setups above ($IWM and $WBAI) should be treated as quick, momentum-based "GONG" (go or no go) trades.

Since most of our "official" swing trade setups are intended to have longer holding periods of at least a few weeks, neither $IWM or $WBAI are listed as "official" setups on today's Wagner Daily watchlist.

Further, both of these trade setups should only be considered by intermediate-level traders who are comfortable with getting in and out of positions quickly in a volatile market.

Keep It Tight!

When market conditions are not ideal, tight protective stop orders are a MUST!

Most traders have a tendency to do the opposite by widening their stops in a bad market.

When conditions are ideal, wider stops make sense because a stock can have a bad day and still recover quickly.

But in a weak or weakening market, stocks do not recover as well and can melt down in a hurry.

As such, it pays to run with tight stops on all trades right now (unless you are holding an intermediate-term position with a large profit buffer and do not mind giving back some gains).

Overall, the main stock market indexes appear to be oversold in the short-term, but stocks could easily see more downside if Wednesday's lows are broken.

Because of this, I would not look to establish more than a few long positions (at most) at low-risk entry points (and with very small position size to further minimize risk).

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.