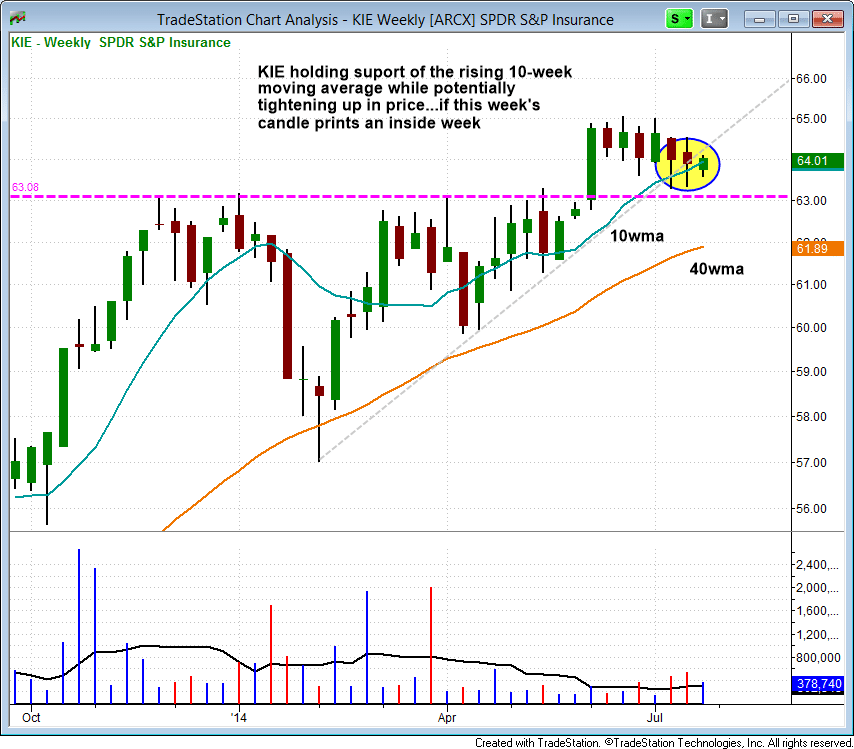

Deron Wagner is monitoring the price action in Insurance ETF (KIE) for a low risk entry point off the 10-week moving average.

On the ETF side, we are monitoring the price action in Insurance ETF ($KIE) for a low risk entry point off the 10-week MA. Note that the price action has tightened up this week (so far).

If $KIE can close out the week in a tight range it will have formed a bullish inside week, which would produce an ideal entry point above this week's high next week:

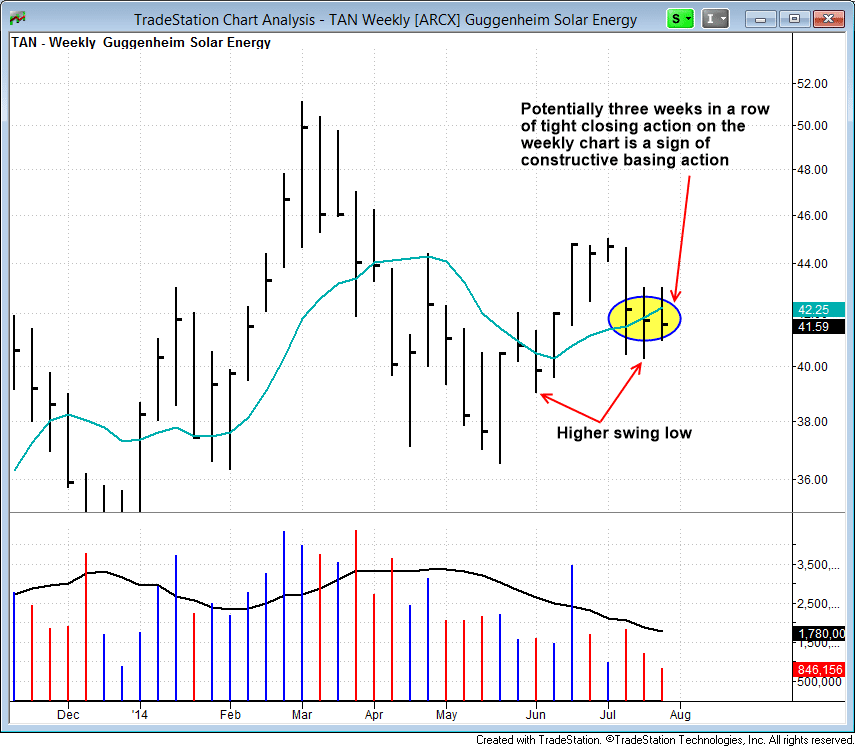

Our current long position in solar ETF ($TAN) is potentially forming a "three weeks tight" pattern on the weekly chart, if this week's close is around $41.50. Three weeks tight is a constructive pattern within a base. Take a look:

If the recent swing low above $40 holds, $TAN will have two higher swing lows in place since bottoming out in May. While $TAN isn't ready to attack the highs of the current base, we will look to add to the position if it continues to act well.

The Nasdaq 100 is still showing clear relative strength as it continues to extend above the last swing high. The S&P 500 closed above the last swing high, but the price action was not very convincing (+0.2% gain on slightly higher volume). The Nasdaq Composite added +0.4% on a 9% increase in volume, but fell short of the range high. The small and mid-cap averages continue to lag, closing slightly negative on the day.

The NASDAQ Composite printed a second straight day of accumulation, but with volume picking up at the highs of the range, there is the possibility that some of that volume was due to selling into strength.

Ideally, the NASDAQ Composite would stall at the highs here and consolidate for a few more weeks to produce a four to five week consolidation above the rising 10-week MA, which would give the moving average a little more time to catch up.

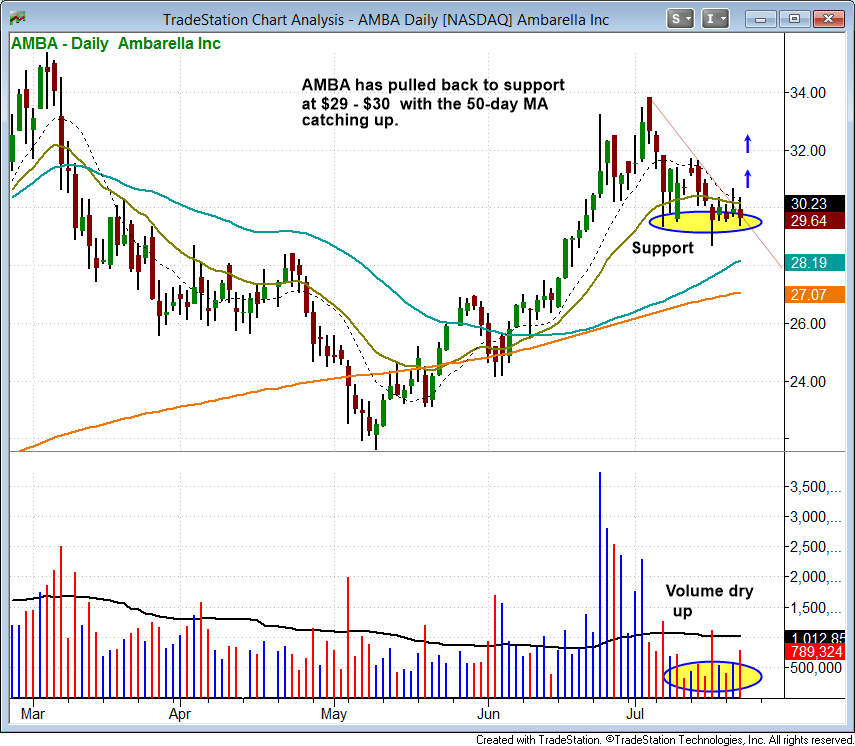

Ambarella ($AMBA) is in pullback mode after stalling out around $33 in early July. Since then the price action has found support around $29, with a bullish shakeout candle on July 17.

Note the dry up in volume (bullish sign) during the pullback, with several days trading well below 500,000 shares.

We are looking to take advantage of the short-term weakness in $AMBA with a buy entry on a pullback to support. Subscribing members of The Wagner Daily should note our exact buy trigger, stop, and target prices for this trade setup in the "Watchlist" section of today's report. Since $AMBA reports earnings on September 5, we may need to be patient with the setup.

Just a reminder that the market is heading into the meat of earnings season over the next few weeks, so we could potentially see a pick up in volatility. Please be sure to check for earnings on any new positions before entering.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.