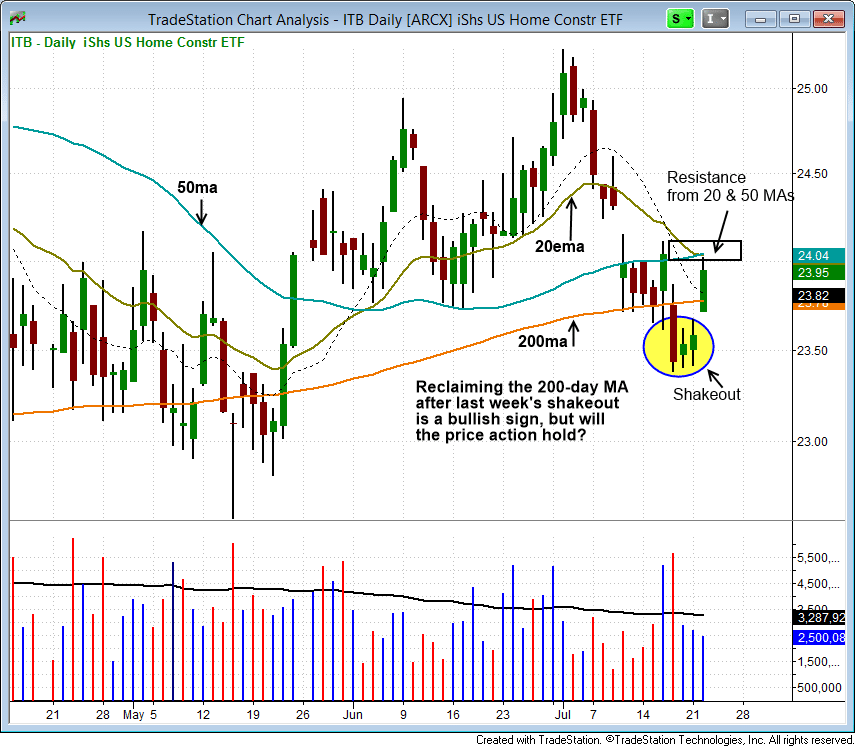

The iShares Home Construction ETF (ITB) reclaimed the 200-day moving average Tuesday after a heavy volume breakdown below the same average last week.

Going into today, there are no new ETF swing trade setups. However, our current long position in iShares Home Construction ETF ($ITB) reclaimed the 200-day MA yesterday after a heavy volume breakdown below the same average last week.

Whenever there is a shakeout below a major support level, we like to see the price action recover back above that level and hold within a few days.

When we find ourselves in a position where there was a nasty shakeout candle, the price action should recover fairly quickly (within a few days to a week, not 2-3 weeks later). If the price does not recover quickly, chances are it is not a shakeout and the pattern may need a few more weeks of base building:

Tuesday's move above the 200ma was a good start, but the price must hold up through the end of the week and deal with resistance from the 20-day EMA and 50-day MA at $24.

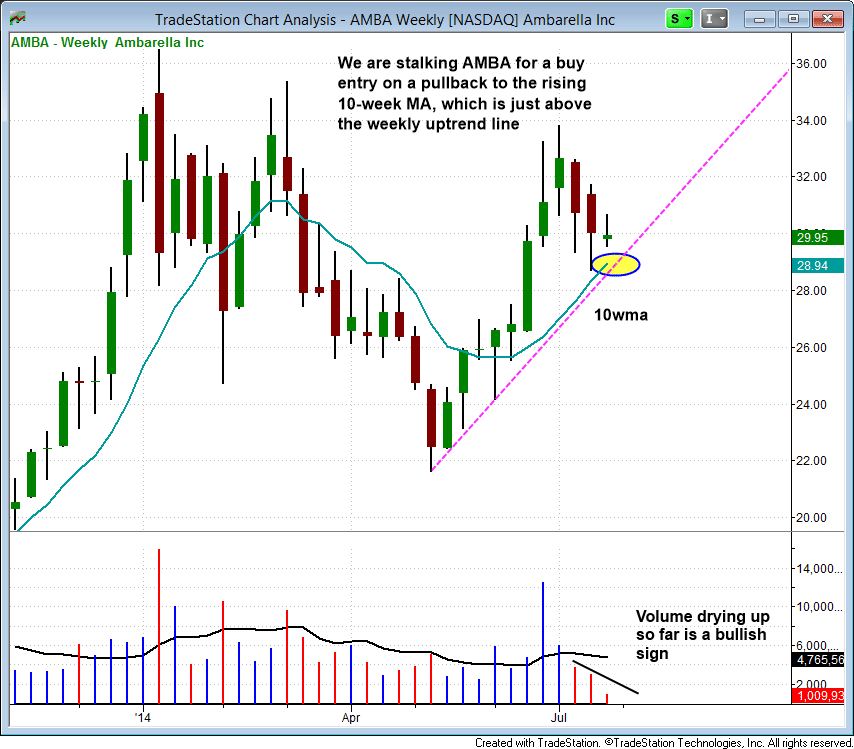

As for individual stock swing trade setups, we are stalking Ambarella ($AMBA) for a low risk entry point on a test of the rising 10-week MA at $29, which is just above the weekly uptrend line:

Although the weekly chart resembles a cup and handle like pattern, the last correction in $AMBA (in April & May) was a bit too deep at 40% off the highs.

Because of this, we feel that $AMBA will need to base out 4 to 8 weeks and correct no more than 20% off the last swing high in June (it is currently on week 3 of its base). At the very least, the correction should hold above $27, which is the 200-day MA on the daily chart.

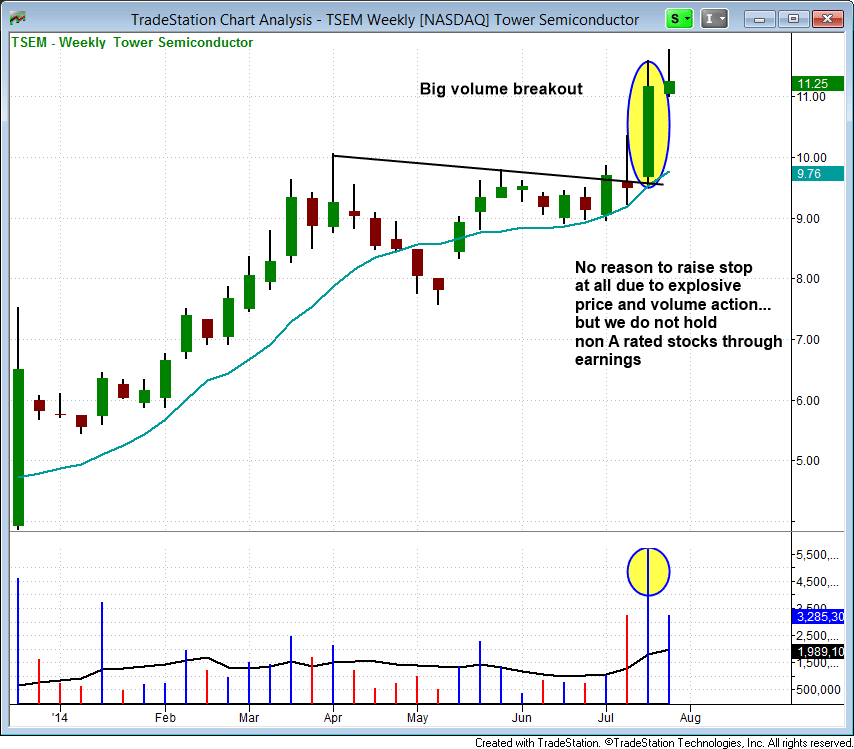

We raised the stop in our current long position in Tower Semiconductor ($TSEM) to guard against a pullback into earnings (August 4). We will not hold this stock through earnings because $TSEM is not an A-rated stock for us, which means it does not have top-notch fundamentals.

When a stock breaks out with explosive price and volume action like $TSEM did last week, the last thing we really want to do is raise the stop. But with earnings around the corner we can't be patient with the price action, which is what we normally do when there is a strong breakout from a valid base:

Subscribers of The Wagner Daily should note the new stop price for $TSEM in the "Open Positions" section of today's report, as we have adjusted it to lock in gains ahead of earnings.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.