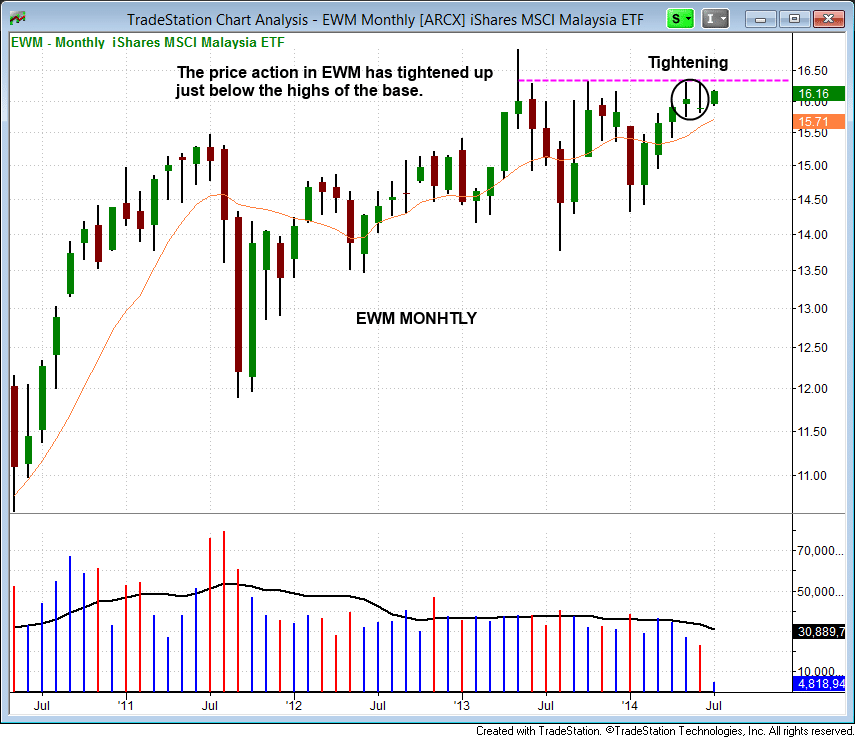

The iShares Malaysia ETF (EWM) could be setting up potential big breakout.

Our weekend scans did not produce much in the way of ideal ETF buy setups, but we are monitoring $TAN and $PHO for low-risk entry points to emerge sometime this week.

Our scanning process is extremely important to what we do, as it basically acts like a gas pedal. When there are plenty of bullish setups around we are confident and step on the gas. When there aren't many setups around, we have no choice but to lay low and wait for the charts to clean up.

Having a consistent scanning process allows us to operate in the now by trading what we see, not what we think!

Our current long position in iShares Malaysia ($EWM) is setting up for a potential big breakout on the monthly chart below:

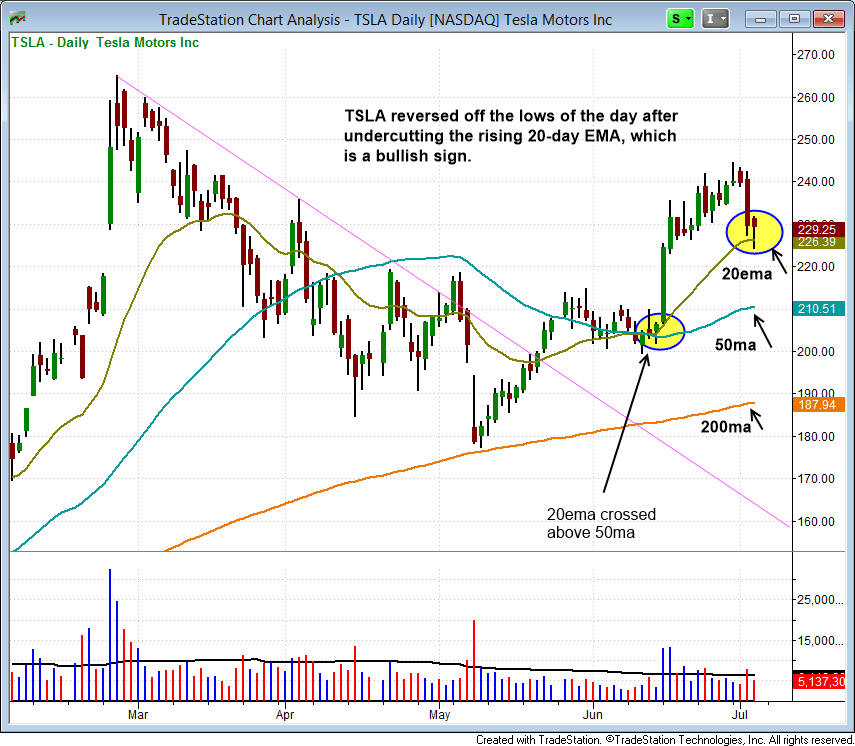

After a few months of basing action and lagging the market, leading stock Tesla Motors ($TSLA) is building momentum on the daily chart:

$TSLA first broke the daily downtrend line around $200 in May. That move was followed by a tight, sideways consolidation at the 50-day MA which it cleared with big volume in June. The move through the $210 area pushed the 20-day EMA back above the 50-day MA. Since then, the 50-day MA has turned up and all three averages are now pointing in the same direction.

$TSLA pulled back to and found support at the rising 20-day EMA last Thursday, which was a bullish sign. Let's see if the action can hold $220 this week and eventually test the prior swing high. Per last Wednesday night's Wagner Daily watchlist, we established a long entry in $TSLA on a pullback to support at the 20-day EMA.

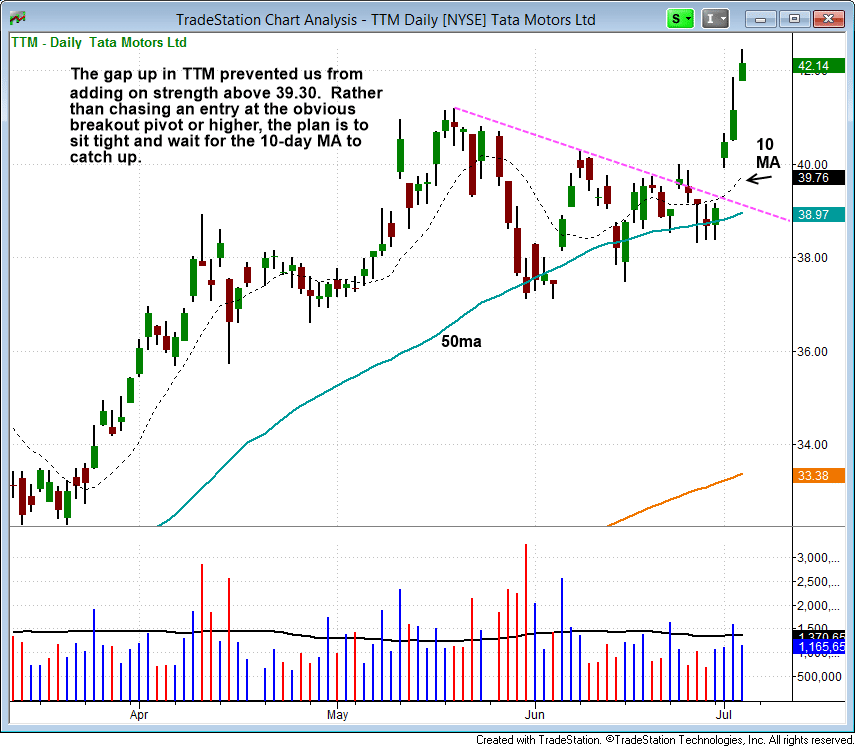

When we sold out of half of our position in Tata Motors ($TTM) six or so candles ago, the plan was to add back those shares on a move out after holding support at the 50-day MA. Unfortunately, $TTM gapped up and took off, making it impossible to add to the position without buying at an obvious point.

Rather than complain about what could have been, the right mind set here is to simply go with the flow and add to $TTM on a pullback to the rising 10-day MA (if we get one). If not, there will be other stocks and opportunities down the road. We try to avoid chasing a stock with a bad entry, which puts us in a position of weakness. The key to operating from a position of strength is to locate low risk entry points.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.