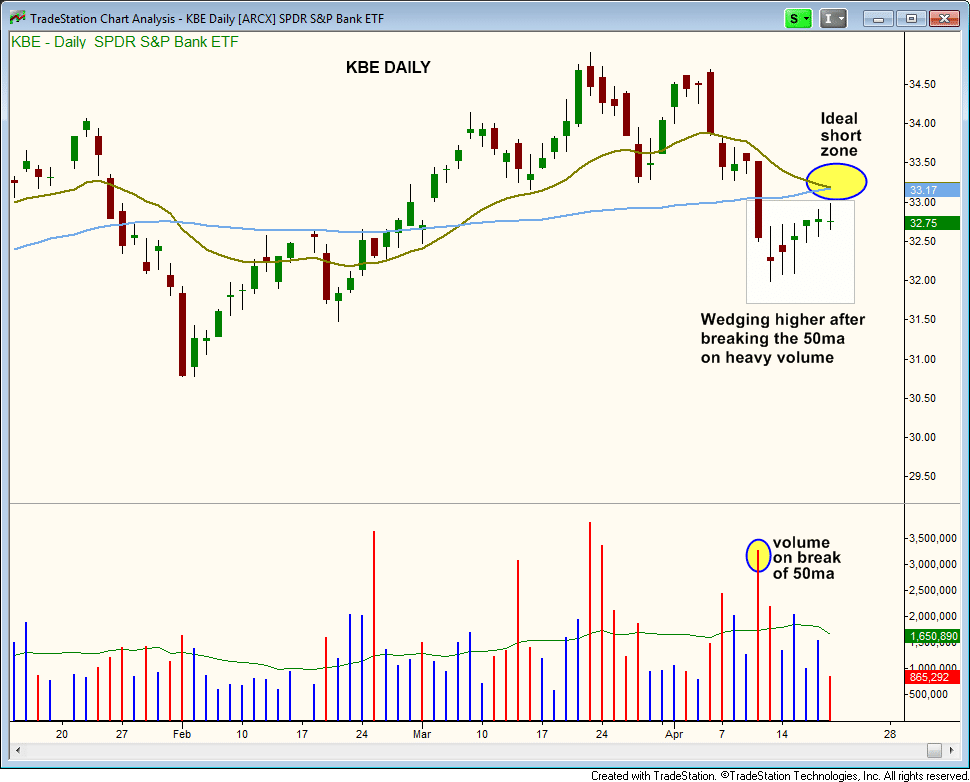

The Banking ETF (KBE) recently sliced through the 50-day moving average on heavy volume, and has since wedged higher on lighter than average volume the past three sessions.

Stocks closed higher across the board, but volume finished about 20% off Thursday's pace, so it was very light. Although the price and volume action has not been that impressive during the bounce off the lows, the market could continue to push higher for a few more days before reversing. Because of this, we feel that it may be a bit too early to get busy on the short side.

The market is being held up by energy, real estate, and utility sectors, while growth type stocks are in repair mode. When leadership is in the defensive sector, we know for sure that it is not our type of market. Still, we are taking advantage of the strength in energy with our current long position in energy ETF ($XOP), which is presently showing a 9.3% unrealized gain since our March 21 entry at $70.70.

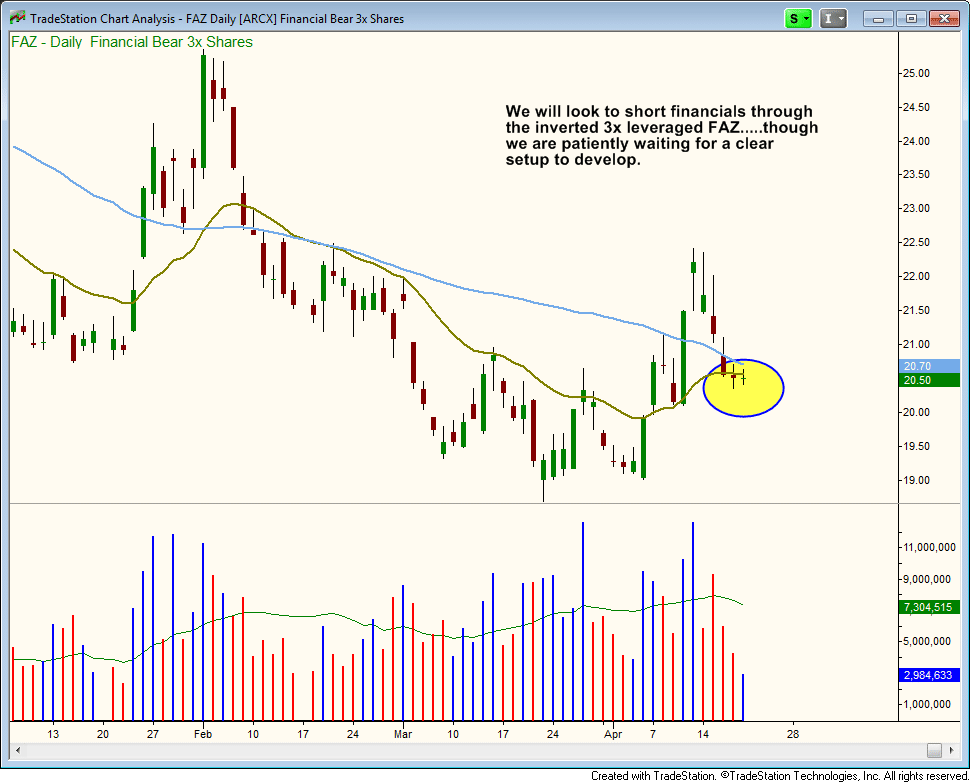

As for the short side, we are monitoring weakness in financial stocks for a low-risk short setup to develop.

Banking ETF ($KBE) recently sliced through the 50-day MA on heavy volume, and has since wedged higher on lighter than average volume the past three sessions:

Ideally, we'd like to see some sort of bounce above the 50-day MA, followed by a bearish reversal candle to provide us with a low-risk entry.

If a short-entry should develop, then we would look to short $KBE by going long the 3x leveraged Financial Bear ETF ($FAZ), which has plenty of liquidity (>7 million shares average daily volume):

As always, we will provide subscribers of The Wagner Daily with our detailed trigger, stop, and target prices for $FAZ if/when it meets our rule-based criteria for swing trade buy entry.

Deron Wagner is the Founder and Head Trader of both Morpheus Capital LP, a U.S. hedge fund, and MorpheusTrading.com, a trader education firm.